Is it possible to say goodbye to mineral coal to protect the environment, including the global climate? The beginning of withdrawals and disinvestments is moving in this direction (Part 1), but the coal industry remains vigorous in certain regions of the world (Part 2), because the outlets for coal are far from drying up (Part 3).

Air pollution from Beijing to New Delhi and global greenhouse gas (GHG) emissions[1], mineral coal is in the dock[2] Can we get rid of it quickly, or will we have to live with it for decades to come?

In support of the first option, calls to stop developing it have multiplied since in 2014 Stanford University launched the “divest-invest” movement mobilizing hundreds of investors and financiers around the world. Numerous studies also conclude that a rapid energy transition is possible in the major coal-consuming countries: China, India, South Africa, Poland, Germany and Australia.

Is this optimism justified? Those who ask “Why is coal so hard to quit?“argue that it is still a ” powerful incumbent“, with huge land resources, backed by powerful companies and powerful governments who see it as the means “to deliver cheap electricity“[3] (Read: Mineral coal: the industry is not giving up). This last observation seems to be confirmed by the share that coal-fired power will probably occupy in the generating fleet of the various regions of the world by 2040[4] (Read: Mineral Coal: A Still Strong Demand).

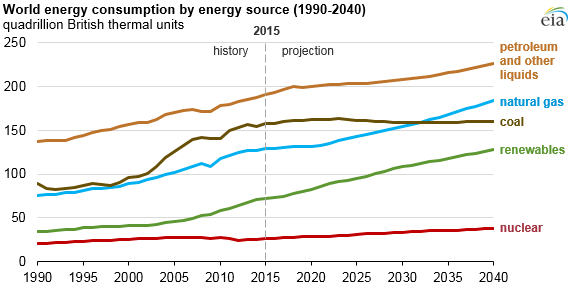

Recent developments do not help to decide between the two perspectives. After slowing down since 2010, global consumption growth did turn negative in 2015 and 2016, but this reversal was short-lived as growth picked up again in 2017, 2018 and 2019[5]. It fell by 5% in 2020 (due to covid-19 pandemic) but should rise again in 2021 (+2.6%?) and then stabilize until 2025. Will it last? (Figure 1). By 2040, the International Energy Agency (IEA) expects near-stability or average annual growth of 1%, depending on its scenarios[6].

Fig. 1. Coal in global energy consumption. [Source : EIA. https://www.eia.gov/todayinenergy/detail.php?id=32912]

Can these prospects be called into question by the numerous declarations, or even decisions, to turn their backs on coal? Despite prices still being very lucrative at the beginning of 2020[7], anti-coal campaigns have begun to bear fruit with both lenders and industrial companies. They are orchestrated by the Powering Past Coal Alliance (PPCA), which Canada and the United Kingdom created to reduce the use of coal-fired power worldwide: at the beginning of 2019, 28 countries, including Israel, have already joined it[8].

1. Banks, insurance companies, sovereign wealth funds, pension funds and others

In Europe, announcements have followed one another since the Norwegian parliament decided in 2015 that the $900 billion Norwegian Sovereign Wealth Fund (NSWF) would withdraw from the capital of all companies with more than 30% involvement in coal activities. Ten major companies immediately lost its support. Others followed: 52 in 2016 and then 122 in 2017, for a total of $8B[9].

At the same time, the Compagnie française pour le commerce extérieur (COFACE) was no longer allowed to finance coal-fired power plants not equipped with Carbon Capture and Storage (CCS) devices (Read: Carbon capture and storage). Among commercial banks, Société Générale, in May 2019, decided to stop dealing with companies whose 50% of their business is related to thermal coal and which do not have an energy transition strategy. At the end of 2019, Europe Beyond Coal, a coalition of European NGOs hostile to coal, absolved Crédit Agricole, which was behaving well, having nevertheless invested €1bn in Europe’s most polluting electricity companies (RWE, PGE, EPH, Fortum/Uniper, CEZ, Enel/Endesa), but denounced BNP Paribas, which had allegedly financed them to the tune of €2.57bn and would continue to support PLN Persero in Indonesia, as well as Axa Finance, which was said to be assisting Adani Mining in Australia[10].

In the UK, Lloyds Banking Group, following the Royal Bank of Scotland, has done the same and is refusing to take on any new clients whose main source of income is coal. HSBC Bank no longer supports any coal projects except those in Bangladesh, Indonesia and Vietnam, which need a delay on the road to a low-carbon economy. In the Netherlands, ING has adopted equivalent principles.

In Germany, after Deutsche Bank, the large reinsurer Munich RE no longer buys shares in companies whose revenues are derived from coal activities (more than 30%) and no longer insures such activities. In doing so, it is imitating the other major reinsurer Swiss RE and the Norwegian insurer Storebrand, which at the end of 2018 withdrew its holdings from 64 companies with a view to withdrawing from all coal business before 2026. At the end of 2019, UniCredit in Italy decided to stop financing coal thermoelectricity from 2023, while Credit Suisse confirmed that it would no longer intervene in this field and Liberty Mutual no longer covered the risks of companies whose revenues come from coal in excess of 25%.

In all these countries, public opinion no longer hesitates to challenge certain industrial decisions, such as the one in Germany regarding Siémens’ involvement in the Indian group Adani’s major coal project in Australia. In November 2019, the European Investment Bank said it would no longer finance coal projects from 2022 (Figure 2).

Fig. 2. The European Investment Bank says it wants to turn its back on coal. [Source : European Scientists. https://www.europeanscientist.com/fr/environnement/la-banque-europeenne-dinvestissement-tourne-le-dos-aux-energies-fossiles/]

Until 2020, the United States had not shown much initiative against coal, but that seems to be changing. The third largest pension fund consortium says it is suspending all investments inutilities that derive more than 10% of their revenues from coal-fired power. At the same time, Blackrock says that through its investments it will play a leading role in climate protection.

In Japan, several insurance companies such as Dai-ichi Life Insurance, Nippon Life Insurance or Meiji Yasuda Life have decided to reduce their portfolio exposure to investments in coal companies. As of May 2019, Mitsubishi UJF Financial Group no longer finances coal. In the same region, the Commonwealth Bank of Australia declares, in August 2019, that it will no longer finance coal-fired facilities from 2030. It was followed, a few months later, by the National Australia Bank, which will no longer support coal projects unless their technology helps reduce GHG emissions.

Even China, as part of its policy of greening its financing, declares in early 2019 that it wants to penalize fossil fuel development projects. Of the banks involved in Southeast Asian coal thermoelectricity, 110 say they have limited their financing in 2019 and, by that, halved pre-construction. In early 2020, Hong Kong-based CLP Holdings reveals it will no longer finance Vietnam’s two coal-fired power plants, Vung Ang 2 and Vinh Tan 3. On the same date, China Development Bank (CDB) and China Exim Bank (CEB) sign the Green Finance Leadership Program, which brings together 27 financial institutions adhering to the principles of green finance.

At the end of 2019, the African Development Bank (AfDB) announced that it would not intervene in the Lamu thermoelectric coal project (1,050 MW) in eastern Kenya. In Africa, as part of a claimed green behaviour, Nedbank South Africa decided, on the same date, to stop financing coal mines.

2. Mining, power and other companies

Not all the coal divestments that followed were in response to calls to boycott coal, as some were simply the result of a desire to diversify into more profitable and/or less risky mining activities than thermal coal. This appears to be the case with the sales of some coal assets by large multinational companies.

Rio Tinto was the first to take this route, in January 2013, with the sale of its Australian coking coal mine Mount Pleasant (10.5 Mt/year) to Match Energy Australia, its 40% share in Bengalia (15 Mt/year) to New Hope Corporation and then its subsidiary Coal & Allied Industries [11] to the Chinese company Yanzhou Coal Mining, even though Glencore’s offer was higher. The continuation of this movement to the Queensland coking coal mines was more hesitant, but eventually Winchester South was sold to Whitehaven Coal, Hail Creek (10 Mt/year) and Valeria Coal to Glencore, and then, in 2018, Kestrel (5 Mt/year) to a consortium formed by Indonesian Adaro Energy and EMR Capital, all for $4.15 billion (Figure 3). In South Africa, Rio Tinto’s withdrawal from coal production resulted in the sale of its Riversdale Anthracite Colliery (RAC) subsidiary to Acacia Coal.

Fig. 3. Rio Tinto sells its coal mines to the Chinese. [Source : Pressfrom.info. https://pressfrom.info/fr/actualite/finance/entreprise/-51935-charbon-rio-tinto-prefere-vendre-ses-mines-au-chinois-yancoal-qua-glencore.html]

In the same country, Anglo American sold several mines in 2018, including New Vaal, Kriel, New Denmark and New Largo, representing 24 Mt/year of capacity. In addition, after reversing its decision to abandon the Grosvenor and Moranbah mines in Queensland when coking coal prices had recovered in 2016,[12] the company sold its Drayton mine to Malabar Coal, and then at the end of 2019, its shares in Grosvenor. It did the same, in New South Wales, by selling its Dartbrook mine to Australian Pacific Coal. In the eyes of its managers “thermal coal was taking the backseat on the company’s future investments“.

The strategy of the Glencore group is less clear-cut. At the beginning of February 2019, it announced its intention to cap its thermal coal production, in the name of climate protection, but it still mined between 138 and 142 Mt in 2019, and is counting on 135-145 Mt in 2022, including coking coal production which it has just consolidated by buying Rio Tinto’s mines in Queensland. It is also a stakeholder, with Peabody, in the “super pit” project, i.e. an extraction of 10 Mt/year, in the Hunter Valley.

BHP-Billiton, alone or as part of the Billiton Misubishi Alliance (MBA): after selling several steam coal mines in Australia (New South Wales), Colombia and the United States (New Mexico) in 2017, then leaving the World Coal Association (WCA), announcing a priority for metals and denouncing Donald Trump’s rejection of the Paris Agreement, the Australian major continued its investments in Queensland and increased its coking coal production from Caval Ridge and South Walker Creek. In early May 2019, it announced that it was phasing out thermal coal mining, but it was not abandoning coking coal mining and was continuing its collaboration with the University of Beiging on CCS, because, unlike power generation, steel production will not be able to do without coal for a long time.

Until recently, U.S. companies did not seem to be in a hurry to abandon coal. However, things began to change in 2017 with Peabody Energy’s sale of its Burton (Queensland) mine to New Hope,[13] Consol Energy’s decision to leave the WCA before selling $2.8 billion of coal assets in two years to diversify away from coal, and Cloud Peak Energy’s bankruptcy filing in May 2019.

In Japan, Mitsubishi Corporation’s policy is not so clear. Under pressure from vocal environmental groups, the firm sold almost all of its thermal coal mines in Australia in 2017 and 2018, including the 31.4% stake in the Clermont mine, co-owned with Glencore and Sumitomo Corporation, and the 10% stake in the Glencore-controlled Ulan mine, but at the same time reaffirmed that coking coal remained its core business. In early February 2019, it was the turn of trader Itochu Corporation to divest its Rolleston mine in Australia in the name of helping to combat climate change while Marubeni Corporation halved its coal thermoelectric capacity in favour of renewables. A month later, Sojitz Corporation sells a 30% stake in the Bara Utama steam coal mine in South Sumatra, but does so in order to refocus its business on coking coal. Mid-2019, Komatsu sells its coal assets to focus on copper and nickel. In late 2019, in Russia, Irkutsk Energo is looking to sell its six West Siberian open-pit mines to refocus on hydropower (Figure 4).

Fig. 4. Coal removal from Irkutsk. [Source : Britannica. https://www.britannica.com/place/Irkutsk-oblast-Russia]

In France, Total Group, after selling Total Coal South Africa to Exxaro in 2014, says it will be out of the business entirely by 2020.If it continues, this move could snowball because ” when an investor has restructured its portfolio in this way, it has an interest in supporting public policies that can increase the value of its new investments. For example, tougher carbon pricing policies. In this sense, private interests and public policies favourable to the preservation of natural capital may converge “[14]. In May 2021, the Group’s General Meeting voted a resolution in favour of decarbonising activities.

3. A growing number of states are supporting the movement

Such convergences can be observed in a number of countries that have adopted national strategies away from fossil fuels as part of theIntended Nationally Determined

Contributions (INDCs) of COP 21. In this respect, however, the situations differ significantly from country to country. By withdrawing from the Paris Agreement in the summer of 2017, the United States has taken the lead among the few countries that are totally opposed to abandoning coal (Figure 5).

Fig. 5. President Trump’s hostility to any anti-coal protest. [Source.2000watts.org. http://www.2000watts.org/index.php/energies-fossiles/peak-oil/1040-energies-et-economie-revue-mondiale-janvier-2016.html]

Donald Trump’s election campaign argument, the end of the war on coal resulted in the repeal of Barack Obama’s Clean Power Act (CPA), replaced by the Affordable Clean Energy Rule (ACER), which leaves each state free to set a limit on its GHG emissions. At the beginning of 2020, the Department of Energy (DOE) strongly supported the Coal First Initiative (FIRST stands for Flexible, Innovative, Resilient, Small Transformative), which was supposed to make coal development compatible with environmental protection, because, according to Dan Brouillette, Secretary of Energy, ” there is still a bright future for coal and we just have to continue to develop that”. Much more cautiously, the new administration of President Joe Biden has reinstated the United States in the Paris Agreement and voted credits to reconvert coal regions such as Appalachia.

At the other end of the spectrum, the European Union would like to set an example. Following its commitment under the Paris Agreement to reduce its GHG emissions by at least 40% by 2030, with the help of a sharp rise in carbon prices from €6 to €18/tonne between 2013 and 2018 and a new support expected from the Green Pact for Europe (Read: European Union: climate and energy 2030), most European states have decided to close their last coal mines and give up on coal-fired power (Read: Mineral coal: the industry does not give up).

Between the countries that have decided to turn their backs on coal for good and those that, apart from specific uses, do not wish to abandon it, others are hesitating between the desire to join the environmentalists’ camp and that of continuing to exploit a safe and often very economical source of energy.

The most important of the latter is China (Read: Energy in China: Xi Jinping’s reforms). In its contribution to the COP 21, China committed to stop the growth of its GHG emissions by 2030 by reducing its carbon intensity from 60 to 65% compared to 2005 and by increasing the share of non-fossil fuel sources in its primary consumption to 20%, which means replacing coal. Despite scenarios suggesting that it could achieve this,[15] the construction of coal-fired power plants continues, because, in April 2021, the authorities consider it is impossible to fall below a consumption of 4.2 Gt in 2025.

India has also committed to reducing its GHG emissions by 33-35% by 2030, based on 2005, both by increasing the efficiency of its energy use and by installing 175 GW of renewable power, 60% of which will be solar, before 2022. However, the developments observable in 2020 do not allow us to imagine that it will succeed in doing so, as its addiction to coal remains so strong.

Japan’s prospects are less critical, but they are also far from the commitment to reduce GHG emissions by 26% by 2030. Following the closure of nuclear power plants imposed by the Fukushima disaster, the share of coal-fired power has returned to growth, from 25% in 2010 to 30% in 2018. At that date, 90 power plants were in operation, likely to be supplemented by another 20 or so GW planned for construction.

4. Funding still available

In 2019, the effects of anti-coal campaigns have undoubtedly made it more difficult to finance an energy source dismissed as a Hollywood villain, in the US[16] and elsewhere[17]. They have not, however, dried it up entirely.

Between 2013 and 2016, development banks alone provided coal, from mine to thermoelectric plant, with $38bn and are set to provide another $28bn, compared with $14bn for renewables. The main contributors would be China (15 then 13 G$), Japan (10 then 9 G$), Germany (4 G$), Russia (3 G$) and South Korea (2 then 3 G$)[18]. According to the World Resources Institute (WRI), between 2014 and 2017, 91% of credits and 61% of loans allocated to energy investments by China Development Bank (CDB) and China Exim Bank (CEB) benefited fossil fuel sources.

Many other financiers, including industrial companies, private banks and pension funds, are also involved. Between 2007 and 2014, the most active on a global scale were the Japanese, notably through their investments in Indonesia and the Philippines.

In contrast to some institutional divestments, privateequities have continued to be attracted to coal assets. The 2018 release of Rio Tinto’s assets attracted $1.2 billion in Australia alone and $2 billion raised by the Apollo and Canada Pension Plan Funds.

In Japan, the banking sector, Mitsubishi UFJ Financial Group, Mizuho FG and Mitsui Sumitomo FG are planning to invest more than $10 billion in new coal projects in 2018.

Where are these financial flows directed? Who are the investors? Which countries do they prefer? (Read: Mineral coal: the industry is not giving up).

From the same author: Charbon minéral, pourquoi est-il si difficile de lui dire faieu ? Revue de l’Energie, n°645, July-August 2019 , pp. 60-72.

Notes and references

[1] Or, in 2014, 42% of C02 emissions related to energy combustion, which correspond to 65% of total GHG emissions, including methane and nitrogen oxides, from the use of fossil sources, land and forests. Source: Emissions Database for Global Atmospheric Research( EDGAR), a programme of the European Commission’s Joint Research Center.

[2] Henry Claude (2019). Global warming: “What to hold on to when all seems lost but we refuse to give up”. Le Monde, 25.01.2019.

[3] Sengupta Somini (2018). The world needs to quit coal: why is it so hard? The New York Times, 24.11.18.

[4] Sebi Carine (2019). What explains the rise in global coal consumption? The Conversation, 29 January. For 2019, CoalWeeks.

[5] It increased, in million tonnes of coal equivalent (Mtec) from 5,411 in 2017, to 5,458 in 2018 and 5,564 in 2019, according to the International Energy Agency’s (IEA) Coal 2019.

[6] Excluding the “Sustainable” scenario, which is a normative scenario that has no relation to observed developments.

[7] Or on average $70/t for thermal coals and $150/t for coking coals.

[8] An overview of this movement is presented by Braungardt and others. (2019). Fossil fuels divestment and climate change: reviewing contested arguments. Energy Research and Social Sciences,April, pp. 191-200.

[9] In January 2019, however, environmental advocates protested against the 30% rule that allowed the NSWF to increase its investments in the mining industry by 10% including multinationals Glencore and BHP Billiton.

[10] The Tribune 15.11.2019

[11] Coal & Allied controls many mines in the Hunter Valley and has a 36.5% stake in Port Waratah Coal Services, which owns a coal terminal in the port of Newcastle.

[12] A state in which, Anglo American also continues to operate the old Dawson open pit mine and the Aquila project in joint venture with Mitsui.

[13] But in early June 2019, the same company announced that it would continue to extract coking coal in Queensland.

[14] Henry Claude. Warming, op. cit.

[15] An ambitious exit from coal is possible, according to a report published on January 6 by American and Chinese institutions, which shows that a gradual exit from coal in China at a rate that would make it possible to limit the temperature increase to 2°C or even 1.5°C by about 2050 is possible. Specifically, the study was conducted by the University of Maryland, the Energy Research Institute (ERI) of China’s National Development and Reform Commission and North China University of Electric Power. The report adds that this transition will have to be organized according to three major principles: no construction of new coal-fired power plants; rapid closure of aging coal-fired power plants; and using coal-fired power plants only to meet peak demand on the grid. Regarding the second pillar of the strategy, the study estimates that 18% of the country’s current coal-fired power plants, or 112 GW of capacity, will need to be closed quickly. A first scenario of coal phase-out, carried out for the 2050-2055 horizon and compatible with a 2°C increase in temperature, which would have no real economic consequences, according to the experts, is detailed in the report. A second, more ambitious, scenario for 2040-2045, compatible with a 1.5°C increase, is also explained but would require a “carefully designed phase-out plan and financial compensation mechanism”. Enerpresse, 12488, 13.01.20.

[16] According to Glenn Kellow, CEO of Peabody Energy. Coal Weeks,18.03.2019.

[17] Notably in South East Asia where 170 GW of coal-fired power have been planned to provide 250 million people with access to electricity, “the corporate social responsibility (CSR) initiatives by banks call for investment or loan decisions based not on risks and rewards in a competitive market, but on judgment by corporate management on what is in the interest of society. Doshi Tylak K. (2019). What Would Adam Smith Say About the Rush by Banks to Stop Funding Coal Power Plants? IAEE Energy Forum, second quarter.

[18] Coal Weeks,06.12.2017

[19] Coal Weeks, 11.02.2019

The Encyclopedia of Energy is published by the Association des Encyclopédies de l’Environnement et de l’Énergie(www.a3e.fr), contractually linked to Grenoble Alpes University and Grenoble INP, and sponsored by the Academy of Sciences. To cite this article, please mention the author’s name, the title of the article and its URL on the Encyclopedia of Energy website. The articles of the Encyclopedia of Energy are made available under the terms of the license Creative Commons Attribution– Noncommercial – No Derivative Works 4.0 International.