Having been dependent on imports for a long time, Brazil gained its oil independence in 2007 by relying on the exploitation of its offshore resources, including the so-called “Pre-salt” area. The history of petroleum exploration and production and the role of its main players, including the national company Petrobras, shed light on the story of this conquest.

The discovery of the ultra-deep resources in the Pre-salt area changed the perspective of the Brazilian oil industry. Brazil has moved from the role of an importer of large volumes to the role of an exporter country. According the International Energy Agency’s (IEA) World Energy Outlook of 2017 (WEO) Brazil will be among the world’s top eight producers in 2040, assuming a relatively significant position in petroleum geopolitics.

What is the structure of the Brazilian Oil Sector? To answer this question, we draw on the methodology proposed by Victor et al, by considering how the configuration of the oil sector and its main mechanisms of governance between National oil companies (NOCs), International oil companies (IOCs), government and service companies are directly influenced by government objectives, the nature of geological resources, and government institutions[1]. In this way, we can observe and understand the objectives of many different political parties in Brazil for the oil sector and the evolution of the exploitation of the petroleum resource in Brazil. We will also look at each of the Brazilian governmental institutions that make up the national oil sector, as well as the international petroleum agreements (IPA) adopted in Brazil.

1. Organizations of players in Brazilian oil sector

The configuration of the current Brazilian oil sector is a result of the constitutional amendment of 1995 and, later, the launch of the regulatory framework of 2010. The constitutional amendment of 1995 created the National Agency of Petroleum, Natural Gas and Biofuels (ANP), the National Council of Energy Policies (CNPE), and redefined the structure of Petrobras (a Brazilian semi-public company engaged in the research, extraction, refining, transportation and sale of oil). The new regulatory framework, revised again in 2016, created the Pré-sal Petroleo Brasileiro S.A. (PPSA), added competences to the Ministry of Mines and Energy (MME) and the CNPE and added prerogatives to Petrobras.

Factors such as the adopted economic policy, the industrial and technological level of development, the energy policy objectives and guidelines, and the characteristics of the Brazilian reserves all influenced the formation of the current institutional framework of the Brazilian petroleum sector[2]. For better understanding, it is necessary to have a deeper understanding of each of these main players, and understand its role in the Brazilian oil sector.

1.1 National Agency of Petroleum, Natural Gas, and Biofuels (ANP)

The ANP was created by the Petroleum Law of 1997 to act as a regulator of the oil sector, under the Ministry of Mines and Energy (MME), in the form of a special agency of Indirect Federal Administration.

The ANP is run by a board composed of a Director General and four directors appointed by the President after approval of the appointees by the Senate. It runs in a 4-year term, not coincidental, and can be extended for an equal period[3].

The ANP is responsible for the regulation and supervision of economic activities of the oil industry.The Petroleum Law, amended by the Production Sharing Law, lists the following responsibilities of the ANP related to the exploration and production activities (E&P):

I within its obligations, to implement the national policy of oil, natural gas and biofuels, contained in the national energy policy, pursuant to Chapter I of this Act, with emphasis on ensuring the supply of oil, natural gas and derivatives and biofuels throughout the national territory, and protecting the consumer’s interests with regard to price and products quality and availability;

II to promote studies aimed at limiting blocks for the purpose of granting or contracting under the production sharing system of exploration, development and production;

III to regulate the implementation of geological and geophysical prospecting applied to petroleum, aiming at the collection of technical data for marketing, on a nonexclusive base;

IV to prepare tender protocols and bids to promote the granting of exploration, development and production activities, signing the relevant contracts and supervising their implementation;

VII under Act No. 8078 of September 11, 1990, to directly and concurrently supervise, or through agreements with unit state agencies and the Federal District, the activities pertaining the oil, natural gas and biofuel industries, as well as the way to apply administrative sanctions and monetary penalties provided by law, regulation or contract;

VIII to instruct process in order to state public interest, for purposes of expropriation and imposition of public easements, of areas necessary for the exploration, development and production of oil and natural gas, construction of refineries, pipelines and terminals;

IX to enforce good practices of conservation and rational use of oil, natural gas, biofuels and their derivatives and preservation of the environment;

X to stimulate research and adoption of new technologies in exploration, production, transportation, refining and treatment;

XI to organize and maintain archives of information and technical data relating to regulated activities of the oil, natural gas and biofuels industry;

XII to yearly secure information on domestic reserves of oil and natural gas provided by the companies, and be responsible for their disclosure;

XIV to liaise on matters of common interest with other regulators in the energy sector, including for the purpose of technical support to CNPE’[4].

Regarding the production sharing regime, the ANP has taken a position of technical advisor to the MME in planning the granting of blocks, by direct contract or through bidding rounds. Regarding the promotion of bidding and the monitoring of the subsequent contracts, its obligations were strengthened, as can be seen in the article transcription of Production Sharing Law:

‘Art 11. ANP shall, among other obligations defined by law:

I promote technical studies to support the Ministry of Mines and Energy in the delimitation of blocks that will be subject to production sharing agreement;

II prepare and submit for approval of The Ministry of Mines and Energy of the production sharing agreements drafts, and of the tender protocols in case of the bids;

III promote the bids under item II of the article 8 of that Act;

IV enforce best practices in the oil industry;

V review and approve, in accordance with the provisions of section IV of the article hereof, plans for exploration, evaluation and production development as well as the annual work programs and production relating to production sharing agreements, and

VI regulate and supervise the activities conducted under the production sharing system under section VII of art. 8 of Act No. 9478 of August 6, 1997’[5].

The ANP has contractual autonomy in the preparation of the tender protocol and the concession agreement and PSA, although it has to submit the documents to the approval of the MME in the case of production sharing regime[6].

The Onerous Assignment and Petrobras Capitalization Law established ANP’s obligations as the acquisition of the technical report of area appraisal, to support the government in negotiations with Petrobras, and the regulation and supervision of the activities to be performed by Petrobras based on the law in reference.

By the end of 2017, the ANP carried out fourteen bidding rounds for the concession of exploratory blocks, four rounds for the concession of marginal fields, three rounds under the production sharing regime, in addition to conducting the signature processes of the contracts of Zero Round and Onerous Assignment.

1.2 National Council of Energy Policies (CNPE)

The Petroleum Law created the CNPE as an advisory body for the Presidency of the Republic, chaired by the Minister of State for Mines and Energy, to formulate energy policies and guidelines[7]. Its creation was an initiative of Congress, in a contrary sense to the current policy of minimizing state interference[8].

The composition of the CNPE was defined in its internal regulations, as transcribed below[9]:

Article 2 – Compose the Plenary of the National Council of Energy Policy:

I – the Minister of State for Mines and Energy, who will preside over it;

II – the Minister of State for Science and Technology;

III – the Minister of State for Planning, Budget and Management;

IV – the Minister of Finance;

V – the Minister of State for the Environment;

VI – the Minister of State for Development, Industry and Foreign Trade;

VII – the Minister Chief of the Civil House of the Presidency of the Republic;

VIII – the Minister of State for National Integration;

IX – the Minister of State for Agriculture, Livestock and Supply;

X – a representative of the States and the Federal District;

XI – a representative of civil society specialized in energy;

XII – a representative of a Brazilian university, specialized in energy;

XIII – the President of the Energy Research Company – EPE; and

XIV – the Executive Secretary of the Ministry of Mines and Energy

The internal regulations allow the participation, without voting rights, according to the agenda, of the ANP director general, the president of Petrobras, the president of the National Economic Development Bank (BNDES) and other authorities related to the Brazilian energy sector.

With regard to the CNPE’s role related to the upstream of the Brazilian oil sector, the Petroleum Law, amended by the Production Sharing Law, established that the CNPE must propose to the President of the Republic national policies and specific measures aimed to:

- promote the rational use of energy resources in the country;

- define the blocks to be subjected to concession or production sharing;

- define the strategy and policy of technological and economic development of the oil industry, natural gas, other fluid hydrocarbons and biofuels, as well as its supply chain;

- cause an increase in the minimum levels of local content of goods and services, to be followed in biddings and concession and production sharing agreements, as set forth in item ‘iii’[10];

Since its creation in 1997 until 2003, the CNPE’s interference in upstream activities, especially in the bidding rounds, was not very significant. This was due to the liberal orientation of the government at the time, headed by Fernando Henrique, of the Brazilian Social Democracy Party (PSDB). With the arrival of the Workers’ Party (PT) to power, after the election of Luiz Inácio Lula da Silva (known commonly as Lula), government intervention in the oil sector activities increased. From the Fifth Bidding Rounds, held in 2003, CNPE began authorizing studies to define the blocks to be offered in the bidding rounds, and began to carry out these auctions, approving the blocks to be offered[11].

The new regulatory framework further intensified the participation of the CNPE in E&P activities, especially for production sharing bidding rounds, as can be seen by the transcript of the CNPE´s competences established in the Production Sharing Law[12]:

Art. 9 The National Council for Energy Policy – CNPE has the responsibility, among

others defined in the legislation, to suggest to the President:

I – the pace of block hiring under the production sharing system, observing energy

policy, development and the domestic industry ability for the supply of goods and

services;

II – the blocks that will be used for direct contracting Petrobras under the production

sharing system;

III – the blocks that will be the object of procurement auctions under the production

sharing system;

IV – the technical and economic parameters of production sharing agreements;

V – the definition of other regions to be classified as the pre-salt area and areas to be

classified as strategic, keeping up with the evolution of geological knowledge;

VI – the oil marketing policy for the Federal Government in the production sharing

agreements, and

VII – the policy for commercialization of natural gas from the production sharing

agreements, subject to the domestic market supply priorities.

In addition, the Production Sharing Law states that the CNPE must propose to the President of the Republic the cases in which Petrobras will be contracted directly by the government for carrying out E&P activities, considering the national interest and other objectives of the energy policy. The CNPE must also propose the contracting parameters[13].

The recent amendment of the Production Sharing Law endowed the CNPE with a new responsibility. After selecting the blocks to be offered under the production sharing regime, the CNPE should offer Petrobras the preference of being an operator. Upon receipt of the Petrobras response, the CNPE shall present the blocks that might be operated by Petrobras to the Brazilian President, indicating their minimum participation, which may not be less than 30%.

With regard to the onerous assignment agreement, the Onerous Assignment and Petrobras Capitalization Law establishes that: “The contract and its revision shall be submitted to the prior appreciation of the CNPE”.

1.3 Ministry of Mines and Energy (MME)

The MME was created in 1960, then eliminated in 1990 with its roles transferred to the Ministry of Infrastructure, and again recreated in 1992.

The Petroleum Law, published under the period of a liberal administration, limited the role of the MME on E&P activities to carrying out studies and sectoral planning with the Brazilian sedimentary basins technical data bank, maintained by the ANP.

Drafted by a more interventionist government, the Production Sharing Law has significantly expanded the MME’s competencies, giving it an important role in planning the Production Sharing bidding rounds. By transcribing the Production Sharing Law it is possible to verify such affirmation:

‘Art 10. The Ministry of Mines and Energy shall, among other responsibilities:

I – plan the exploitation of oil and natural gas;

II – suggest to the CNPE, once the ANP has been heard, the definition of blocks that will be subject to concession or production sharing agreements;

III – suggest to the CNPE the following technical and economic parameters of production sharing agreements:

(a) criteria for the definition of the Federal Government’s profit oil;

(b) the minimum percentage of the Federal Government’s profit oil;

(c) the minimum participation of Petrobras in the consortium stated under art.20, which may not be less than 30% (thirty percent);

(d) the limits, deadlines, criteria, and conditions for the calculation and appropriation by the contractor of the oil cost and the production volume corresponding to the royalties owed;

(e) the minimum local content and other criteria related to the development of national industry, and

(f) the amount of the signature bonus, and the part to be allocated to a public company, stated in x1 of art. 8;

IV – establish guidelines to be observed by ANP to promote the bid under item II of the article. 8, as well as the preparation of tender protocol drafts and production sharing agreements, and

V – approve the tender protocol drafts for the bidding and for the production sharing agreements developed by ANP.[14]

In addition, the Production Sharing Law also assigns the following attributions to the MME:

- to promote, prior to contracting, the evaluation of the pre-salt and strategic areas potential, directly or through the ANP;

- to sign production sharing contracts;

- to authorize the transfer of rights and obligations related to the Production Sharing Agreements (PSAs);

- to establish the technical, financial and legal requirements that the transferee must meet.

The Onerous Assignment and Capitalization of Petrobras Law does not mention the MME, it generally mentions the government. However, the MME with the Ministry of Finance represented the government in the signature of the onerous assignment agreement.

1.4 Petróleo Brasileiro S.A. (Petrobras)

Petrobras was created by Federal Law No 2.004/53 as a joint stock company to run the Federal Government’s monopoly over the activities of research, extraction, refining, trading and transporting of oil.

Federal Law No 2.004/53 was revoked by the Petroleum Law, which established the status of Petrobras as a private and public joint stock company, linked to the MME. This law determined that the federal government would maintain a majority stake of Petrobras owning at least 50 per cent of the shares, plus one share of the voting capital.

The Petroleum Law established the purpose of Petrobras to be the exploration, mining, refining, processing, trade, and transport of oil, and that it shall perform such activities on free competition grounds and depending on market conditions. The Petroleum Law also authorized Petrobras to perform any of the activities listed in its corporate objective outside the national territory. Moreover, Petrobras and its subsidiaries were allowed to form consortia with domestic and foreign companies, as head or not, with the goal of expanding activities, gathering technologies, and expanding investments applied to the petroleum industry.

The Petroleum Law allowed Petrobras to keep the E&P rights in relation to exploratory blocks and production fields in activity, and determined that the ANP should sign concession agreements with Petrobras, bidding exempted[15]. After that, Petrobras could participate in future bidding rounds for exploratory blocks under equal conditions with other competitors, being assured preference only in case of a tied bid, when running alone.

The Production Sharing Law initially defined Petrobras as operator of all blocks contracted under this regime, ensuring a minimum participation in the consortium of 30% (thirty percent), in cases where there is an auction. This law also allows Petrobras to participate in the bidding process to grant PSAs under equal conditions of competition when it intends to increase its 30% (thirty percent) share in the consortium. When it does not participate in the bidding round, Petrobras should agree with the bidding rules and the winning proposal.

The Production Sharing Law was amended at the end of 2016, changing these provisions. Petrobras now has the preemptive right to the operation of the blocks to be offered under the production sharing regime and must send a statement to the CNPE about its preferences accompanied by a justification. After receiving Petrobras’s statement, CNPE will propose to the Brazilian President which blocks should be operated by the NOC, indicating its minimum participation in the consortium, which cannot be less than 30% (thirty percent) [16]. The Decree that regulated these new provisions defined that, in the hypothesis of Petrobras exercising its preemptive rights, it may refuse the PSA signature if the offer is above the minimum established in the tender protocol[17].

The Production Sharing Law allowed the direct contracting of Petrobras for the signature of PSAs, exempted from bidding, and also for the exploratory studies necessary for the appraisal of the pre-salt and strategic areas[18]. Petrobras may also be contracted by PPSA, exempted from bidding, to commercialize the profit oil[19].

The Onerous Assignment and Petrobras Capitalization Law established Petrobras as the sole contractor, exempted from bidding[20].

1.5 Pré-sal Petroleo Brasileiro S.A. (PPSA)

The PPSA was created in 2010, as a public company, linked to the MME. However, it was only established in 2013. The object of the PPSA is to manage the PSAs granted by the MME and to manage the profit oil commercialization agreements. The purpose of the PPSA is to maximize the economic result of PSAs and the profit oil commercialization agreements. However, the PPSA is not responsible for carrying out, directly or indirectly, the oil exploration, development, production, and commercialization activities[21].

The creation of PPSA was inspired by the Norwegian regulatory model[22]. This is because Norway has a mixed capital NOC, Statoil, and another NOC, 100% public, Petoro, with the requirement to perform financial management, including accounting, from the State’s Direct Financial Interest Fund[23]. It is worth mentioning that through this fund the Norwegian government can participate directly in E&P activities as a common operator, unlike PPSA. However, when the fund mentioned in Production Sharing Law has been established, PPSA, as its manager, will have more similarities to Petoro[24].

PPSA is run by a president and three directors, in a 3-year term, and can be extended for an equal period. PPSA has two councils, one administrative and another fiscal. The Administration Council is composed of five members appointed by the Brazilian President. The five positions are each appointed, respectively, by the MME; the Ministry of Finance (MF); the Ministry of Planning, Budget, and Management (MPOG); the Civil House and the president of PPSA. The mandate’s term is four years, with re-appointment allowed[25].

PPSA’s Internal Regulation lists its responsibilities, as can be seen from the following transcript:

I – to perform all acts necessary for the management of production sharing agreements signed by the Ministry of Mines and Energy, especially:

(a) to represent the Federal Government in the consortia formed for the implementation of production sharing agreements;

(b) to protect the interests of the Federal Government in operational committees;

(c) to technically and economically evaluate plans of exploration, appraisal, development and production of oil, natural gas and other fluid hydrocarbons, as well as to enforce the contractual requirements relating to local content;

(d) to monitor and audit the implementation of projects of exploration, appraisal, development and production of oil, natural gas and other fluid hydrocarbons;

(e) to monitor and audit costs and investments related to production sharing agreements, and

(f) to provide the National Agency of Petroleum, Natural Gas and Biofuels (ANP) with the information necessary for its regulatory functions;

II – to carry out all the necessary acts for the management of contracts for the commercialization of petroleum, natural gas and other fluid hydrocarbons of the government, especially:

a) sign contracts with marketing agents, representing the government;

b) verify compliance by contractors with the government’s commercialization of petroleum and natural gas policy; and

c) monitor and audit the operations, costs and sales prices of oil, natural gas and other fluid hydrocarbons

III – to analyze seismic data provided by ANP and by contracted parties under the production sharing system; and

IV – to represent the Federal Government in the unitization procedures and the resulting agreements, whenever the deposits of the pre-salt and strategic areas extend over areas not granted or not hired under the production sharing system.

The PPSA will join the PSA consortium as the government’s representative and will appoint half of the members of the operational committee, the entity responsible for the consortium management. The PPSA will also appoint the chair of the operational committee, which will have the power of veto and quality vote. Thus, it will have a dominant position in the management of the operational committee of any consortium formed to enter into a sharing agreement[26].

The PPSA participates in the operational committee, which might bring some significant risks for private investors[27]. The first refers to the asymmetry of information in the decision-making process. Due to its dominant position, the PPSA will deliberate on several situations on behalf of the other consortium members having less information than them, especially if compared to Petrobras, who has a deep knowledge of the Brazilian sedimentary basins. The second refers to moral hazard. The PPSA, as it cannot be held liable for any damages, may decide which operations increase the risks. However, if something goes wrong, the consortium members would bear the loss. Another risk is the possibility for Petrobras to influence the PPSA’s decisions against the interests of other consortium members, exercising its dominant position in the consortium when it is an operator. Also Petrobras would have a direct connection with the presidency and with ministers of state, in addition to having some of its former employees in the PPSA[28]. As there are only a few production sharing contracts signed, it is still too early to analyze whether the risks are really significant.

The PPSA’s interface with the concession and onerous assignment regime occurs when there is a unitization agreement (UA) between a non-contracted area located in the pre-salt and an area subject to one of these contracts. By the end of 2017, PPSA had signed four UAs for the following fields:

- Tartaruga Verde (concession regime);

- Lula (concession regime) and Sul de Lula (onerous assignment regime);

- Sapinhoa (concession regime);

- Argonauta (concession regime).

Six agreements are under negotiation for the following fields:

- Pirambu; Albacora; Baleia Azul; all under the concession regime;

- Sul de Sapinhoa and Atapu, under the onerous assignment regime.

The PPSA also negotiated an agreement for the Mero field, included in the Libra area, the first PSA, while being the government representative for the non-contracted area and the management of the PSA.

2. Brazilian Fiscal Systems

Before analyzing fiscal regimes and their respective international agreements adopted in Brazil, it is necessary to say that there are many classifications of regulatory systems in the specialized literature. Here we will divide the institutional arrangements for the exercise of E&P activities into two systems: contractual (compensatory or remuneration) and concession[29]. The main point of differentiation between the two systems is the ownership of oil after production.

These systems can be further classified in three main categories:

- concession regime, in which the State grants the right of an International Oil Company (IOC) to carry out E&P activities and appropriate the hydrocarbons produced;

- compensatory contractual regime and

- remuneration contractual regime[30].

In the latter two, the right to exercise E&P activities is state-owned. The Host Country (HC) contracts an IOC for the exercise of such activities, compensating it, as in the production-sharing contract, or remunerating it, as in the service contracts, as a counterpart.

It is important to mention, however, that another methodology exists that focuses on contractual arrangements[31]. There are four basic arrangements used by HCs to grant E&P rights to IOCs. These are:

- Concession

- Production Sharing

- Service Contract and

- Participation Agreement[32]

Although they are used for the same purpose – i.e., the definition of oil revenue breakdown – these models present different concepts, especially regarding the control of IOCs, compensations, and the level of involvement of HCs.

It is relevant to emphasize that it is not always possible to frame the model adopted in a country in the categories discussed above. Many countries adopt elements from two or more of the basic models. Thus, these specific models are classified as hybrids. These contracts consider the political, financial, economic, and resource needs of the country in which they are signed[33]. Hybrid arrangements are becoming more frequent, resulting in different contracts being adapted to the specifics of the areas to be granted[34].

Brazil has adopted the contractual and concession systems[35]. The concession system presents two types of agreements: concession and onerous assignment. For the contractual system, the agreement adopted was production sharing. All are hybrid forms, but the onerous assignment is the only one that does not find a reference in any of the pure contractual.

2.1 Concession System

Brazil has two agreements in which the State grants the right of an IOC to carry out E&P activities and appropriates the hydrocarbons produced; they will be presented hereafter[36].

2.1.1 Concession Agreement

The Brazilian concession agreement has a hybrid design and incorporates features of other types of contract adopted by the oil industry, such as the risk service agreement and the participation agreement[37]. This happens because in the Brazilian concession agreement there is a requirement to perform a minimum exploratory program and the concessionaire must take the risk of losing the investment in case there is no commercial discovery, as established by the risk service agreement. The similarity with the participation agreements is observed in relation to the variable participation of the government due to the production volume since the Brazilian concession agreement provides for the collection of progressive participation for productive fields.

The Petroleum Law establishes that the concession agreements will be signed after a bidding process, in which E&P rights will be offered. The concessionaire will have the ownership of the oil extracted, and must pay the government take on the production[38].

The concession agreement may only be signed with companies established under Brazilian law, with headquarters and administration in Brazil, which have previously met the technical, economic, and legal requirements established by the ANP[39].

The term of the Brazilian concession contract is divided into two phases: exploration and production. In the exploration phase, the concessionaire must carry out a minimum exploratory program. In the eventual discovery of oil or natural gas, it must carry out the appraisal activities to determine its commerciality. This phase has a variable duration, defined by the ANP in the tender protocols, with the possibility of extension in accordance with the conditions established in the agreement. The production phase includes the development activities. This stage lasts 27 years, starting from the declaration of commerciality, which can also be extended or rescinded by the concessionaire, provided that the latter notifies the ANP at least six months in advance[40].

Among the requirements of the concessionaire established in the Brazilian concession agreement, there are local content commitments in the exploration production phases. Until the Thirteenth Round, local content was the criteria for judging the offers in the bidding rounds. This configuration followed the government policy of the Worker’s Party that aimed to promote national industry. However, the high local content indices required were difficult to achieve due to the lack of capacity of the national industry. The replacement of the Worker’s Party by the Brazilian Democratic Movement Party (PMDB) led to the change of this policy. At the beginning of 2017, the CNP published Resolution n. 7/2017 determining that for the Fourteenth Round the local content commitments would be defined in the notice, no longer being criteria for judging the offers.

With regard to the government take on the Brazilian concession agreement, the Petroleum Law establishes the following modalities:

- signature bonus, with payment being a condition for the signature of the contract;

- royalties, required after the start of production;

- special participation, charged in cases of high volume of production or high profitability;

- payment for occupation or retention of area, due to the beginning of the contract term[41].

The Petroleum Law also establishes for the Brazilian concession agreement, when the block is located onshore, the payment to the landowners of equivalent participation, at a variable percentage between 0.5% and 1% of the oil production [42].

The concession agreement requires the concessionaire to take measures to preserve reservoirs and other natural resources, adopting the best practices of the international oil industry, and performing all operations assuming the risks and costs of the activity[43]. The concessionaire is still required to notify the ANP of the operations development and of any damage and injury caused by such operations.

Before the end of the concession period, the concessionaire is required to carry out the activities of decommissioning and abandoning wells. They should also remove equipment and facilities, and the ANP might demand the reversion of assets[44].

The concession agreement requires the procedure of unitization when the deposit extends beyond the boundaries of the block to which the exploration rights were granted.

2.1.2 Onerous Assignment Agreement

The onerous assignment contract was drafted based on the concession contract of the Tenth Bidding Round, in accordance with the provisions of Onerous Assignment and Petrobras Capitalization Law. Thus, it can be said that the onerous assignment agreement is a hybrid form of the concession agreement since it grants property rights over the oil produced and requires the payment of royalties, essential characteristics of the concession agreement. Therefore, it fits into the concession system[45].

The onerous assignment agreement has been said to be “a very specific, very peculiar regime”, an agreement that resembles with that of concession, but is not confused with that of concession[46]. This is because the risk arrangement of the onerous assignment agreement is quite different from the risk arrangement of the concession agreement[47]. In the concession, an IOC or even Petrobras, if it has not made any commercial discovery after the conclusion of the exploratory period, should finalize the contract. In the onerous assignment agreement, as Petrobras has been granted the right to explore and produce up to 5 billion barrels of oil, if this company cannot produce all this volume, there must be an adjustment through the revision of the agreement. Thus, the onerous assignment agreement will only be concluded when the 5 billion barrels are reached, even if Petrobras paid in advance for these barrels.

The term of the onerous assignment agreement is 40 years and may be extended for another five years, at the request of the assignee, under the terms of the agreement.

The onerous assignment agreement has two phases: exploration, which includes appraisal activities and production, which includes development activities. The exploration phase has a maximum duration of four years for the execution of the activities of the Mandatory Exploratory Program, defined in the agreement, and of any additional work. Failure to comply with this program will result in the imposition of a fine for Petrobras, up to twice the amount listed in the agreement for the activities previewed for the block, and in a case of a delay of more than twenty-four months[48]. The extension of this stage is allowed for another two years. The production phase shall commence after delivery of the declaration of commerciality.

The assignee, Petrobras, is obliged to take on an exclusive basis all the investment costs and risks related to the operations. In case there is a commercial discovery, the assignee is entitled to the ownership of oil produced as of the measurement point of production. However, its rights are limited to the production of 5 billion barrels of oil equivalent.

In relation to local content, the assignee is required to meet the minimum percentage of 37 per cent during the exploration phase, and 65 per cent in the production phase, also the assignee must meet the requirements of minimum percentages of local content of specified items and subitems in Annex IV of the contract. However, for the development phase, the contract establishes a progressive percentage, as follows:

- 55 per cent for the units starting production until 2016

- 58 per cent for the units starting production between 2017 and 2019, and

- 65 per cent for the units starting production as of 2020

With regard to the government take, royalties will be due only over the mined product worth 10 per cent of production, paid monthly to the Federal Government as of the start of the production. However, the contract requires the assignee to realize qualified expenditures such as research and development in an amount equivalent to 0.5 per cent of the production annual gross revenue.

After the production of 5 billion barrels, or upon termination of the contract by lapse of time or by any other reason, the assignee shall submit to the ANP the oil field relinquishment report. If this report shows the possibility of depletion of production during the contracted period, the assignee must submit a program of decommissioning, proposing the form of plugging and abandonment of wells, decommissioning and removal of plants and equipment. With regard to the assets employed by the assignee, the general scheme of the contract of the onerous assignment agreement is the non-reversion of assets, which may occur in exceptional cases to ensure the continuity of the operations or when they might be of some use by public need.

Onerous Assignment and Petrobras Capitalization Law provides that the onerous assignment agreement is not transferable, thus blocking the possibility of assignment.

The unitization shall be mandatory whenever the deposit extends beyond the contract area. As the onerous assignment agreement area is entirely located in the pre-salt polygon, the provisions of Production Sharing Law must be adopted.

Onerous Assignment and Petrobras Capitalization Law establishes the possibility of contract revision to be held after the submission of a commerciality report.68 The onerous assignment agreement defines that the revision could result in the renegotiation of the following items:

- the contract value,

- maximum volume,

- validity term, and,

- minimum percentage of the local content contained in Annex IV.

The revision is conditional to the full compliance with the Mandatory Exploration Programme and prior consideration by CNPE.

In 2013 and 2014 Petrobras declared the commercialization of the six areas of the onerous assignment agreement, which originated the fields of Sul de Lula, Buzios, Sul de Sapinhoa, Itapu and Sepia and to the development areas of North of Berbigão, South of Berbigão, North Of Sururu, South of Sururu and Atapu. Thus, the process of reviewing the onerous assignment contract started.

In addition, the CNPE published Resolution n. 01/2014[49] approving the direct contracting of Petrobras to produce in a production sharing regime the volume surplus authorized in the onerous assignment agreement for the fields of Buzios, Itapu and Sepia and for the development areas of Norte de Berbigão, Sul de Berbigão, Norte de Sururu, Sul de Sururu and Atapu.

Considering that from the end of 2014 the financial situation of Petrobras was compromised due to the effects of the corruption scandals, the political situation in Brazil, and the fall in the price of the oil barrel, the processes for reviewing the onerous assignment agreement and direct contracting of Petrobras have not yet been concluded[50].

According to PIW Jan. 16’17, there are efforts to change the law to allow the participation of private companies in the onerous assignment since Petrobras requires technical and commercial collaboration to continue these projects.

2.2 Compensatory Contractual System

Brazil has only one agreement under a compensatory contractual system: the Production Sharing Agreement, which will be presented hereafter.

2.2.1 Production sharing agreement (PSA)

The compensatory contractual system was chosen to grant E&P rights in the Pre-salt area and in strategic areas, through the signature of a production sharing agreement. The granting of such rights may be performed by direct contracting of Petrobras with the CNPE proposing the parameters of the agreement, or by means of a bidding round process. In latter case, Petrobras is entitled to preemptive rights in the operation of the areas to be tendered. When exercising this right, Petrobras must have a minimum participation of 30% (thirty percent) in the consortium that submitted the offers. Petrobras may participate in the bidding round under conditions of equal competition in the event to increase its participation. If the offer that wins the bid is higher than the minimum stated in the tender protocol, Petrobras will still have the right to withdraw from the consortium.

Since the publication of the Production Sharing Law in 2010, three bidding rounds have been carried out and seven agreements have been signed. The first bidding round took place in 2013 and concerned the Libra area. The second and third bidding rounds took place in 2017.

The Production Sharing Law allows the MME, directly or through the ANP, to promote the appraisal of the Pre-salt and strategic areas potential prior to the offer in a bidding round, and, for this purpose, the MME may directly contract Petrobras to carry out exploratory studies.

The Brazilian PSA is limited to 35 years, divided into two phases: exploration, which includes the appraisal of eventual oil discovery to determine its commerciality, and production, which includes development activities. Unlike the contracts of the concession system, the PSA does not have different terms for each phase. Therefore, in order to extend the production phase, it is necessary that the contracted consortium reduce the exploitation phase.

The term and the conditions for the extension of the exploration phase are established in the agreement, as well as the minimum exploratory program that the contractor must accomplish at this stage. For the bidding round of the Libra prospectus for example, the duration of the exploration phase was four years.

The contractor under a production sharing regime shall assume all risks of exploration, appraisal, development and production activities, bearing the costs and investments required to execute the PSA. If there is a commercial discovery and start in production, the contractor will be entitled to recover such costs in kind, excluding payments of government take. Such costs shall be approved by the operating committee and recognized by the PPSA contract manager.

Production will be shared between the government, represented by the PPSA, and the contractor. The latter will receive reimbursement of costs in oil and part of the remaining production, called profit oil. Pinto Jr. defines cost oil as “the volumes of oil and natural gas whose ownership is transferred to the contractor to cover the recoverable costs (exploration, development, operation and abandonment costs).” The profit oil is defined in the Production Sharing Las as[51]:

‘quota of oil production, natural gas and other hydrocarbon fluids to be divided between the Federal Government and the contracted party, according to criteria defined in the contract, resulting from the difference between total volume of production and the quotas related to the cost oil, to the royalties due, whenever required, to the participation dealt in Art. 43’ (participation of landowners).

The percentage of profit oil that will be received by the government will be proposed by CNPE, when Petrobras is directly contracted, or will be the criterion of the offer judgment, proposed by the winner of the contest. In the Libra Bidding Round, e.g., the minimum percentage proposed in the tender protocol for the profit oil was 41.65% and was the percentage offered by the winning consortium.

The Brazilian PSA requires a consortium formed by PPSA and Petrobras, when it is directly contracted, or by PPSA and the successful bidder when a bidding round is carried out. In this case, Petrobras may be an operator if it has exercised its preemptive rights and has not withdrawn from the consortium after the outcome of the auction. The PSA’s operational committee will manage the consortium. This committee will be composed of PPSA representatives, who will appoint their president and half of their members, and the representatives of Petrobras and the successful bidder, if any.

Regarding government take, the Brazilian PSA provides only two types:

- signature bonus, to be paid upon the signature of the contract and cannot be reimbursed by cost oil, and

- royalties, which cannot be included in calculating the cost oil. There is also the contribution of up to 1% of the oil production, due to the landowners, whenever the strategic blocks are located onshore.

The PSA is more rigorous than the concession agreement in relation to environmental protection, since it requires the mandatory submission of periodic inventory on emissions of gases causing greenhouse effect, the submission of a contingency plan for accidents due to leakage of oil, natural gas and other hydrocarbons and their derivatives, the mandatory environmental audit of the entire operational process of withdrawal and distribution of oil and gas from the pre-salt, and upon termination of the contract, the acts of environmental recovery determined by the competent authorities.

Upon completion of the production sharing agreement, the contracted party must perform the decommissioning and relinquishment of areas under contract, including the removal of equipment and facilities that are not subject to reversion, and also for the reversion of assets. The contracted party must still repair or compensate for the damage caused by its activities.

The PSA may be assigned, provided there is prior written consent of the MME after the ANP has been heard. However, the following conditions must be met:

- the contractual object and its conditions cannot be changed,

- the concessionaire must be evaluated technically, economically and legally, based on criteria established by the MME, and

- the other consortium members shall hold pre-emption right, relative to their consortium shares.

Regarding unitization, the procedure is mandatory for deposits that extend beyond the boundaries of the block and the ANP must approve the agreements. Libra must be the first PSA to have a UA.

Production Sharing Law lists the chances of termination of the production sharing agreement, namely:

- the expiration of the term,

- upon agreement between the parties,

- upon Resolution for the reasons specified in the contract,

- after the exploratory phase without any commercial discovery have been made,

- upon using the right of withdrawal after the fulfilment of the minimum exploratory program in the whole or after payment of the amount corresponding to the portion not fulfilled, and

- upon the refusal to signing the unitization agreement.

Conclusion

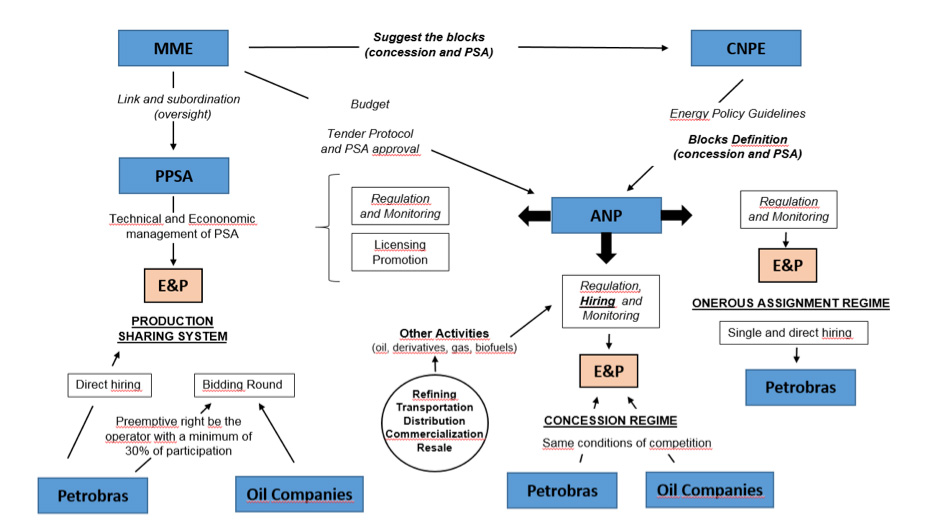

This article presented the structure of Brazilian oil sector, details the agents, and the contractual arrangements. The interaction between the agents follow the Brazilian rules for E&P and depends on the fiscal regimes. This can be represented with the follow scheme[52]:

In the concession regime, the CNPE starts the bidding process authorizing the ANP to study the areas which might be offered, and to carry out the bidding round. Usually in the same act, the CNPE authorizes the bidding round and the council does the selection of areas. The head of the MME runs the CNPE. Then, the interface between the ANP and the CNPE regarding concession agreements is facilitated by the MME. The ANP signs the concession contract and authorizes the transfer of rights. PPSA will interact with the concessionaires and the ANP under this regime only in the case of unitization of an open area located in the Pre-salt polygon.

In relation to production sharing regime, the CNPE must define which blocks will be granted directly to Petrobras. After that, the council could authorize the ANP to study the areas which might be offered. The CNPE must ask Petrobras if it wants to be an operator of Pre-salt areas in the study by the ANP. After Petrobras decides, the CNPE could define the parameters of a PSA, and then authorize the ANP to carry out the bidding round. The MME must sign the PSA and will be the entity which will authorize the PSA’s transfer of rights. The PPSA will have the operational committee of the PSA, be responsible for management of the PSA.

Regarding Onerous Assignment Regime, the ANP drafts the agreement and submits it for the MME’s approval. The MME and the MF, representing the government, sign the agreement. The CNPE must authorize the revision, based on studies developed by the MME. The ANP coordinates the agreement revision process. As in the concession regime, the PPSA will interact with Petrobras and the ANP under the onerous assignment regime only in the case of unitization of an open area located in the Pre-salt polygon.

However, this regulatory design for E&P activities has not yet been fully consolidated. After the new framework established in 2010, only three bidding rounds for the granting of PSAs was carried out. The result of the first PSA bidding round generated some criticisms that instigated some changes instituted in 2017. The review of the onerous assignment agreement has not been performed yet; its discussion began in 2014 and may cause more changes in the rules in force. President Temer’s government shifted the policy orientation to a liberal government. Thus, new amendments in the Brazilian regulatory framework were incorporated, changing the bidding round design for the concession regime and for the sharing regime. The next bidding rounds will test this new design and show if any new adjustments are needed. In addition, in 2018 there will be new presidential elections, and if the result leads to a change of economic model, more changes may occur.

Acknowledgment

I am grateful to Prof. Catherine Locatelli, Prof. Helder Queiroz and Sylvain Rossiaud for all the advice in the drafting of this article.

Notes and references

[1] Victor, David G.; Hults, David R.; and Thurber, Mark C. (2011) Oil and Governance, 1st ed. Cambridge University Press. New York

[2] Paz, M. José. (2014) Oil and Development In Brazil: Between An Extractive And An Industrialization Strategy. Energy Policy 73.

[3] Federal Decree No 2,455/1998, art 5°

[4] Federal Law No 9,478/1997, art 8°

[5] Federal Law No 12,351/1997, art 11

[6] Aragão, Alexandre Santos de. (2006) O Contrato de concessão de exploração de petróleo e gás. Revista Brasileira de Direito do Petróleo, Gás e Energia, UERJ Rio de Janeiro

[7] Federal Law No 9,478/1997, art 2°

[8] Leite, Antonio Dias. (2007) A Energia do Brasil. 2 ed. Elsevier. Rio de Janeiro

[9] CNPE Resolution No. 07 of 2009: http://www.mme.gov.br/documents/10584/1139155/RESOLUxO_CNPE_7_.pdf/1efa32f8-47ce-455e-b37f-e89fe27658d9 accessed 15 mar 2018

[10] Federal Law No 9,478/1997, art 2°

[11] See CNPE Resolution No 8/2003: http://www.mme.gov.br/documents/10584/1139143/Resolucao08.pdf/7928ddb5-f763-4159-8891-148b4166a0be accessed 15 mar 2018

[12] Federal Law No 12,351/1997, art 9°

[13] Federal Law No 12,351/1997, art 12

[14] Federal Law No 12,351/1997, art 10

[15] Federal Law No 9,478/1997, arts.33, 33 and 34

[16] Federal Law No 12,351/1997, arts. 4°

[17] Federal Decree n. 9,041 of 2017, art. 1°

[18] Federal Law No 12,351/1997, art. 12

[19] Federal Law No 12,351/1997, art. 45

[20] Federal Law No 12,276/2010, art. 1°

[21] For more information: <http://www.presalpetroleo.gov.br/ppsa/a-ppsa/empresa> accessed 15 mar 2018

[22] Oliveira, Daniel Almeida de. (2010) Pré-sal: o novo marco regulatório das atividades de exploração e produção de petróleo e gás natural do Brasil. Revista da AGU. Brasília

[23] For more information: <https://www.petoro.no/about-petoro> accessed 15 mar 2018

[24] Campos, Thiago Neves de; Sartori, Vanderlei. (2010) O modelo norueguês de exploração e produção de petróleo e suas lições ao Brasil. In: Rio Oil & Gas Conference 2010. Instituto Brasileiro de Petróleo, Gás e Biocombustíveis. Rio de Janeiro

[25] Federal Decree n. 8,063 of 2013, Annex

[26] Victor et al (n. 1)

[27] Florêncio, Pedro. (2016) The Brazilian 2010 Oil Regulatory Framework and Its Crowding-out Investment Effects. Energy Policy 98: 378–89.

[28] All the eight PPSA’s directors designated by the Brazilian President has worked at Petrobras. For more information: <http://www.presalpetroleo.gov.br/ppsa/a-ppsa/diretoria-executiva> accessed 15 mar 2018

[29] Johnston, D. (1994) International petroleum fiscal systems and production sharing contracts. Pennwell. Tulsa

[30] Tolmasquim, Mauricio Tiomno; Pinto Júnior, Helder Queiroz. (2011) Marcos regulatórios da indústria mundial do petróleo. Synergia. Rio de Janeiro.

[31] Duval, Claude; Leuch, Honoré Le; Pertuzio, André; Weaver, Jacqueline Lang; Owen, Anderson L.; Bishop, R. Doak; Bowman, John P. (2009) International petroleum exploration and exploitation agreements: legal, economic and policy aspects. 2nd ed. Barrows. New York

[32] Smith, Ernest E.; Dzienkowski, John S.; Owen, Anderson L; Lowe, John S.; Kramer, Bruce M.; Weaver, Jacqueline Lang. (2010) International petroleum transactions. Rocky Mountain Mineral Law Foundation. Westminster, EUA

[33] ibid

[34] Pinto Jr., Helder Queiroz. (2016) Economia da Energia: Fundamentos Economicos, Evolucao Historica e Organizacao Industrial. Elsevier. Rio de Janeiro

[35] Johnston (n. 29)

[36] Tolmasquim and Pinto Júnior (n.30)

[37] Ribeiro, Marilda Rosado de Sá. (2013) Direito do Petróleo. 3. ed. Renovar. Rio de Janeiro

[38] Federal Law No 9,478/1997, art. 26

[39] Federal Law No 9,478/1997, arts. 5°and 25

[40] CNPE Resolution n. 2/2016 authorized the ANP to extend the term of concession agreements from Round Zero. For more information: <http://www.mme.gov.br/documents/10584/3201726/Resolu%C3%A7%C3%A3o_2_+CNPE.pdf/245a081f-0e3c-4f6a-a384-260b6c7f97a7> accessed 15 mar 2018

[41] Federal Law No 9,478/1997, art. 45

[42] Federal Law No 9,478/1997, art. 52

[43] Ribeiro (n. 37)

[44] For more information see ANP Resolution No 27/2006: <http://nxt.anp.gov.br/NXT/gateway.dll?f=templates&fn=default.htm&vid=anp:10.1048/enu> accessed 15 mar 2018

[45] Johnston (n. 29)

[46] Lopes, Luiz Vicente Sanches. (2011) Unitização: estudo de um caso à luz do novo desenho do ordenamento jurídico brasileiro. FGV. Rio de Janeiro

[47] Marques Neto, Floriano de Azevedo. (2010) A Competição pelos direitos de exploração do pré-sal. Universidade de Brasília. Brasília, DF

[48] Sousa, Francisco José Rocha de. (2011) A Cessão onerosa de áreas do pré-sal e a capitalização da Petrobras. Brasília. Available in: <http://www2.camara.gov.br/documentos-e-pesquisa/publicacoes/estnottec/tema16/2011_907.pdf>. Accessed 10 Mar 2018. Consultoria Legislativa. Câmara dos Deputados.

[49] Sousa (n.48)

[50] For more information: <http://www.petrobras.com.br/fatos-e-dados/esclarecimento-sobre-o-processo-de-revisao-do-contrato-de-cessao-onerosa.htm> accessed 15 Mar 2018

[51] Federal Law No 12,351/2010, art. 2°

[52] Caselli , Bruno Conde. (2012) Redesenho institucional e arranjos contratuais: uma análise da regulação e da indústria de petróleo e gás natural no upstream brasileiro. UFRJ: IE. Rio de Janeiro. In: http://www.ie.ufrj.br/images/pos-graducao/pped/dissertacoes_e_teses/Bruno_Conde_Caselli.pdf. Accessed 07 September 2017. The original squeme was translated and updated according the recent changes in Brazilian E&P regulatory framework.

L’Encyclopédie de l’Énergie est publiée par l’Association des Encyclopédies de l’Environnement et de l’Énergie (www.a3e.fr), contractuellement liée à l’université Grenoble Alpes et à Grenoble INP, et parrainée par l’Académie des sciences.

Pour citer cet article, merci de mentionner le nom de l’auteur, le titre de l’article et son URL sur le site de l’Encyclopédie de l’Énergie.

Les articles de l’Encyclopédie de l’Énergie sont mis à disposition selon les termes de la licence Creative Commons Attribution – Pas d’Utilisation Commerciale – Pas de Modification 4.0 International.