How to meet the challenge of combining electricity investment with security of supply and decarbonisation objectives? The failures of the energy only market suggest a hybrid regime combining planning, risk-sharing arrangements for investments and improved market design.

The liberalization reforms of the electricity sector in the 1990s introduced an institutional regime in which equipment decisions and investment risk management are privatized and decentralized among competing agents (See: Les marchés électriques : complexité et limites de la libéralisation des industries électriques). This role used to be based on public planning and electricity monopolies (See: L’électricité : entre monopole et compétition), as well as on the transfer of investment risks to consumers through tariff regulation (See: Marchés de l’énergie : la couverture des risques). But the situation has changed in countries that are committed to achieving the priority objectives of security of supply and decarbonization. Public authorities are once again the main decision-makers in terms of technology choices, power mix and reserve margin to keep up with growing needs, ensure security of supply and steer the low-carbon transition, while ensuring that producers’ investment risk is shared through long-term arrangements with the government. The shift is even clearer in emerging economies that had liberalized and privatized, but are facing rapid demand growth. The need to invest in all technologies at a high rate makes these economies pioneers in hybridizing the market regime through planning and risk-sharing public contracts.

But these policy and regulatory interventions, especially those that rely on the development of variable renewables energy sources (VRE) for electricity decarbonation, have important repercussions on the functioning of electricity markets by creating inconsistencies between the different “blocks” of market design (See: Électricité : La vente au coût marginal et Électricité : l’orientation rationnelle des consommations par la tarification). This requires adjustments to be made to these reforms in order to improve the coherence of this new sectoral regime, which is necessary for its proper functioning.

Two major authors on power markets, David Newbery (Cambridge Univ.) in an analysis evaluating the UK Electricity Market Reform of 2011 (Newbery, 2018) and Paul Joskow (MIT) in his diagnosis of the evolution of electricity markets subject to the large-scale entry of RE in the United States (Joskow, 2019), have identified such a regime shift by explaining it by the need to correct market failures. Joskow does so while regretting that this major fact is not really recognized, which does not facilitate the coherence of institutional transitions (Figure 1).

Fig. 1. David Newberry. Source: energyireland, https://www.energyireland.ie/building-momentum-on-decarbonising-heat-in-ireland/ and Paul Joskow. Source: nber, https://www.nber.org/people/paul_joskow?page=1&perPage=50

This analysis of regime change can be further systematized (see Roques and Finon, 2017) . Beyond the differences in institutional trajectories, this shift to a hybrid regime, which results from the joint pursuit of the objectives of security of supply and decarbonisation, leads in fact to a regime based everywhere on two common principles: short-term coordination by the markets, with a view to achieving efficient economic dispatching, and long-term coordination through planning and the allocation of long-term arrangements between investors and public or regulated entities, based on long-term competition.

The novelty lies in the strength of this logic which, in the OECD economies, is due first of all to the specialisation of decarbonisation policies on renewable energy (RE) techniques, essentially wind turbines and solar photovoltaic (PV), because these techniques are of zero marginal cost and variable output. Their push in the system by non-market incentives distorts all the logic of the short and long term regulation by the market that the reformers had wanted to establish.

What follows is an analysis of the dynamics of the change in market architecture that leads to a market regime “hybridized” by planning combined with “market” award of long-term contracts with investors by auctioning. To this end, we will develop

– firstly, the analytical approach based on a “modular approach” of the market architecture and regulation is specified;

– then are detailed the long-term modules that can be added to the initial market design to allow investments in RE, in peak capacity or eventually, in a more comprehensive way, in all production technologies, following the example of countries or regions that have carried out the most complete reforms, such as those in Latin America, the United Kingdom or Ontario, are detailed,

– in a third step the tensions between the long-term modules and the initial modules are pointed, that require continuous improvement and tuning,

The we conclude by emphasizing the need for clear recognition of the regime change that is occurring as a result of these two public policy objectives.

1. The modular approach of the organisation of electricity markets

A functional approach to the evolution of the rules organizing the functioning of liberalized electricity sectors is based on the institutionalist literature that identifies a certain number of “modules” in the initial market design of the energy-only market, and that treats its different evolutions as the addition of long-term modules, followed by the correction of the inconsistencies introduced by this parachuting in.

The approach is based on the problematic of the “modularity” in the electricity market design (in the manner of Glachant and Perez (2009)), then on the analysis of the rules governing transactions in complex industrial organizations. Analysts of these rules identify homogeneous groups of activities that cannot be separated due to technological constraints, on the one hand, and modules of rules governing the relationships between these groups of activities thus defined, on the other hand.

This approach is particularly useful for analysing the introduction of competition in electricity sectors that were structured as vertical monopolies, since it establishes boundaries:

-between grid activities that remain natural monopolies and are regulated, and

– potentially competitive activities.

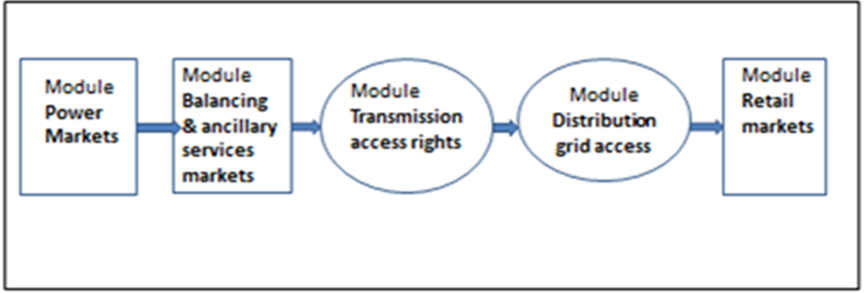

Glachant and Perez thus identified a set of distinct functional and institutional modules along the electricity value chain, each with different potentials for the introduction of market and competition (Figure 2).

The introduction of competition was thus achieved by establishing boundaries between monopolistic grid activities and potentially competitive activities such as production and retailing. Keeping the building block approach provides a relevant framework for analyzing the evolution of institutions under the effect of public policies that pursue objectives of security of supply and decarbonization.

1.1. The modules of the initial market design

The initial liberalized electricity sector comprises three modules of competitive activities and two of regulated activities (Figure 2). This includes:

-the wholesale market module, i.e. the forward, day-ahead or intraday markets, which ensures short-term system optimization hour by hour (economic dispatching); the market design differs from one country to another in several respects because it is based either on a centralized and mandatory pool or on decentralised trade on an exchange. Another difference concern the price setting mechanism, based either on the prices offered, as in the United States, in European countries or in Colombia, or on the variable costs as in Brazil, Argentina, Chile or Peru in the case of a pool. It can also be framed by more or less high price ceilings to limit the volatility of peak prices;

-the balancing and system services module, which includes the balancing mechanism and the reserve market which could be based either on bilateral contracts negotiated with the Transmission System Operator (TSO), or on a reserve market mechanism for different “products”;

-the retail module which defines the market segments open to competition and those with regulated tariffs, when the rules of the regulated sales tariff are maintained to protect small consumers, as well as public service standards such as social tariffs; moreover a tax could be applied on those retail transactions to finance the public service obligations, among others.

In addition to these modules, there are modules for regulated activities:

-the module of access rights to the transmission grid includes the regulation of transmission prices (either in cost of service, or in price cap which is supposed to incentivize to long term efficiency); the spatial design of pricing, which is more or less detailed to take into account congestions inside the system, on the spectrum from nodal pricing to postage stamp pricing, via zonal pricing; and finally the rules of access to interconnections with other systems;

-the distribution grids access module, on the other hand, only includes elementary institutions such as regulation of the distribution service tariff or the responsibility for metering, but it is being expanded with the integration of VRE on its HV distribution network, the spread of smart meters and the transformation of networks into smart grids.

1.2. Modular analysis of sectoral reforms

The functional approach developed to explain the two forms of evolution of the initial market design towards a hybrid of market and planning is based:

– first, on the introduction of new modules to remedy the market and regulatory failures that alter investment incentives, particularly in capital-intensive technologies, more specifically in base-load equipment and peak-load units whose share of fixed investment costs in the total cost is high;

– secondly, on the adjustment of new modules by learning and to make them more in line with their legal environment; the initial modules are also adapted because of the distortions resulting from the large-scale development of variable and zero-cost RE.

2. The addition of long-term modules

Why and how to insert new modules?

2.1. Market failures in the initial market design

In theory, the electricity market has two coordination functions. In the short term, it ensures the efficient dispatch of equipment from producers competing on their short term costs (fuel, O&M). In the long term, it signals capacity shortages for each technology with different cost structures for different services (base load, mid load, peak load) through the price signal that guides investors’ decisions.

There would be a perfect articulation of short-term and long-term decisions under the assumptions of perfect information and the absence of risk aversion on the part of economic agents. For a given equipment, the so-called “infra-marginal” rents (differences between hourly prices and their variables costs) generated on the hourly wholesale markets, to which are added the rents of scarcity during peak periods, make it possible to recover the fixed costs and to ensure a return on the invested capital. In theory, the optimal technology mix resulting from the investment decisions of market players is almost identical to the planner’s optimum, as is the case with the identity of the results of planning for the whole economy and the action of a market in perfect competition, according to Oskar Lange’s pioneering demonstration (Lange, 1935), with the only difference being the risk management costs and the associated transaction costs (figure 3). Pioneering work on electricity markets, however, has put forward the idea that markets for long-term bilateral contracts and risk hedging contracts would develop on their own to allow investors to cover their risks (Bohn et al., 1984; Joskow et Schmalensee, 1983). But two factors have prevented this completeness of the power markets.

2.1.1. The incompleteness of markets

In the real world, power markets have a fundamental incompleteness. On the one hand, there is no financial market for long-term hedging products (Roques et Newbery, 2006; Gross, 2010). On the other hand, wholesale buyers (suppliers/retailers, very large consumers) have little incentive to enter into long-term contracts with a producer because of the misalignment of their interests (Chao, Stoft, Wilson, 2008; Finon, 2011). Suppliers do not want to sign such fixed price contracts because, if the trend in wholesale market prices is reversed, their customers may switch to another supplier who would offer them lower prices. Electricity markets have remained incomplete and are not able to provide the right investment incentives to achieve a socially optimal generation mix, especially in peak and base-load equipment, both of which are capital intensive per megawatt hour (MWh) produced. Only the least capital-intensive equipment, gas-fired combined cycle plant and gas turbines, have been installed because of the short payback periods for these techniques.

Faced with these shortcomings, countries with high demand growth, such as those in Latin America, have undertaken extensive reforms of the initial market design in order to allow investments in the whole spectrum of different techniques by coordinating them. In OECD countries where security of supply is a primary objective, mechanisms for payment of guaranteed power during critical hours have been added to the energy-only market to encourage investment in peak capacity. This is a departure from the theoretical view of the so-called energy-only markets, according to which all investment decisions are made on the basis of hourly price signals and the net revenues that can be expected from them.

2.1.2. The shortcomings of the carbon price signal

Numerous research works have shown that a carbon price, which could be supposed to orient the price signal of the electricity markets, is not sufficient on its own to fully encourage investments in low-carbon technologies among which renewables, for three types of market failures (Jaffe et Stavins, 2008; Finon et Roques, 2008; Lehmann et Grawell, 2013).

– a carbon price emanating from a CO2 permit market will always lack credibility because it cannot send a stable price signal at a high level, a condition to lead to the triggering of investments in low-carbon technologies which are with high CAPEX (capital expenditures);

– capital-intensive low-carbon technologies are exposed to market risks and regulatory risks inherent to RE, nuclear and Carbon Capture and Storage (CCS) policies, which the incompleteness of the electricity markets does not make up for managing these risks (See: Captage et stockage du carbone (Carbon Capture and Storage – CCS));

– low-carbon innovations in the technical and commercial maturation phase must be subsidized, because during this phase, economic agents who cannot benefit from the learning externalities that benefit other economic agents have less incentive to invest in immature techniques at the level that would result in the social optimum in the case all the benefits could be appropriated. It follows that long-term arrangements that guarantee investor revenues must be used to stimulate investment in low-carbon technologies, initially to subsidize them in the innovation phase and then to compensate for the failing carbon price (Grubb et Newbery, 2008; Newbery , 2011; Finon et Roques, 2013).

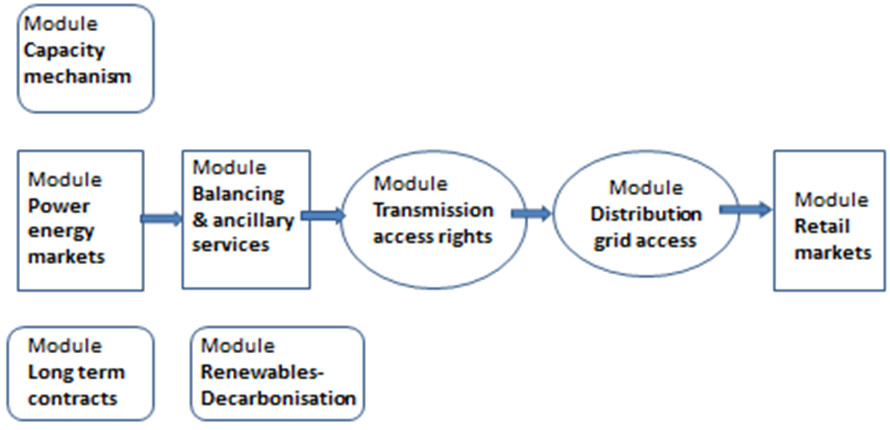

Three long-term modules – capacity mechanism, RE support schemes and auctions for long-term contracts – can then be added to the initial market design to enhance investor revenues, ensure recovery of fixed costs and/or reduce investment risks by sharing them with government and/or consumers (Figure 4)

2.2. The Capacity Mechanism Module

According to the theory of peak pricing (See: Marchés de l’énergie : prix et régulation) (Boiteux, 1949, Joskow, 1976), scarcity situations during peak periods play a key role in the recovery of investment costs through large increases in hourly prices, to 500 to 1000 €/MWh against the usual 50 to 100 €/MWh. These prices provide adequate signals to invest in peaking units. However, energy-only markets cannot by this way guarantee the installation of adequate capacity that ensures security of supply in all situations, for various reasons:

– existing price caps implemented in market designs because high prices are politically difficult to accept, which, as consequence, removes the scarcity pricing that would, in theory, be sufficient to trigger investment in peaking units;

– the risk aversion associated with investments decided on the basis of very uncertain revenues from scarcity pricing;

– and, more generally, the difficulty of covering the investment risk for these investments in peaking units with revenues that are subject to fundamental uncertaintyCramton, Stoft, 2006, 2014; Joskow, 2008; Roques, 2008; Keppler, 2017).

This market failure is exacerbated by the development of VRE which amplifies price volatility during peak periods and increases this uncertainty. Some also mention the possibility of collusion between producers to maintain a barely sufficient capacity at peak times, in order to capture more scarcity rent. The problem is amplified by the lack of responsiveness of demand to prices, which leads to a rise in prices at the extremes in critical periods.

The solution lies in the introduction of a capacity remuneration mechanism (CRM), with a wide range of options that have different performances in terms of effectiveness in preserving a sufficient reserve margin. Without going into detail, the most effective mechanisms for achieving reserve margin objectives in a timely manner and avoiding the problem of exercising market power are those based on a “quantity instrument”, as opposed to the “price instrument” of capacity payment, which does not guarantee that the capacity adequacy objective will be met (De Vries, 2007; Finon et ignon, 2009).

The first instrument combines planning by setting a reserve margin objective, and auctioning of forward contracts for a remuneration of the guaranteed power at a given date, generally four years from now, to allow the installation of new peak units. This principle is structuring several designs of CRM, the centralized auctions of forward contracts, a system adopted in several US states, in the United Kingdom and recently in Italy, and the decentralized capacity obligation imposed on suppliers in proportion to their market shares, a system recently adopted in France. It should be noted that capacity remuneration gives in all cases an advantage to dispatchable power plants compared to variable generation techniques (VRE) which, when involved in the mechanism, only benefit from a limited number of capacity credits per MW due to their low probability of availability at full load during critical periods. In the end, the cost of the capacity guarantee is paid by the consumers, via an uplift in the transmission tariff in the centralised mechanisms, given that it is the system operator who contracts with the producers.

It is interesting to note that three of Latin American countries that reformed their electricity markets during the 2000s in order to guarantee both reliability of supply and capacity adapted to their growing demand (Brazil, Colombia, Peru) have installed in their market design mechanisms for awarding long-term contracts that remunerate both capacity and energy. The United Kingdom followed a similar path in its 2011 electricity market reform by installing a capacity mechanism based on long-term forward contracts of 15 years for new conventional power plants (not RE) and one-year contracts for existing power plants. These contracts contrast with the Forward Capacity Mechanisms adopted in several states in the United States, whose contracts only remunerate the capacity guarantee over a single year.

It should be noted that in the European Union (EU), the Commission has been reluctant to allow the adoption of these mechanisms, which it considers to be subsidies and state aids. Consequently, the rules of competition policy, in particular the “guidelines on state aid in energy”, restrict the autonomy of member states’ decisions in this area, by subjecting their choices to in-depth supervision with dissuasive effects.[1]

2.3. The renewable energy – decarbonization module

Public arrangements that guarantee the investor’s income have traditionally been used to stimulate investment in renewable energies up to now, but not in other low carbon technologies. In favour of the latter, feed-in tariffs have been widely used in European countries for RE since 1995: they guarantee a 20-25 year income per MWh aligned with the cost-price anticipated by the regulator in agreement with the developers. This is currently the case of the flexible premium, or the so-called “remuneration complement”, which is added to the hourly market price to guarantee such an income per MWh: it is paid within the framework of a long-term contract awarded by auctions regularly opened by the regulator for new projects.

These arrangements are generally structured along the same lines as the UK’s Contracts for Differences (CfDs), which are based on a symmetrical option to guarantee revenue per MWh over the long term. A CfD is a long-term financial contract between two parties, usually referred to as “buyer” and “seller”, that stipulates that the seller (here the government) will pay the buyer the difference between the current value of the energy in the hourly market and its value in the contract (if the difference is negative, the buyer pays the seller instead). CfDs are in fact symmetrical option contracts that guarantee a long-term income to the investor. This change preserves the function of the feed-in tariff system, which was to de-risk investments in RE, alongside the other initial function of subsidising their extra costs during the learning phase. This function is disappearing as RE technologies approach commercial maturity and see their costs established at the level of other power generation techniques (Nreuhoff et May, 2018) .

But not all the support mechanisms for renewable energies are based on the same principles than the FIT or the CfD. It is the case of the green certificate obligation imposed on suppliers in proportion to their sales, a mechanism that was and is used in the United States and in several European countries, including the United Kingdom until 2017. But it should be noticed that, with this particular system, appears the same need for long-term risk-sharing contracts for triggering investments in RE. Indeed, the experience gained both in the United Kingdom with the Renewables Obligation in place from 2000 to 2017, and in the United States with the Renewables Portfolio Standards (RPS) reveals that the logic of these decentralized obligations leads investors and suppliers to conclude long-term contracts to share the risks which are more important for them than for an investor benefiting from the previous arrangements (Mitchell and Baucknecht, 2006; Wiser et al., 2007; Joskow, 2019). In the end, the decentralized obligation turns out to be much less efficient in terms of effective installations and more expensive, because the risk premium to invest. This explains why the United Kingdom, a pioneer country, preferred to abandon it and adopt technology-based auctions for long-term CfD-type contracts, and for small RE installations, for feed-in tariffs.

It should be added that the approach of limiting the risks for investors has been extended to other low-carbon technologies, notably new nuclear power, with the difference that the first contracts for investments in the four new nuclear reactors, Hinkley Point C and Sizewell C, have been, or will be, drawn up in a negotiated manner or in a regulated asset based manner, to take into account the specific nature of the projects, i.e. the scale of the investment, the large-scale complex technology and the fact that they are in the process of re-learnings.

It should be noted that in Europe, recent changes in feed-in tariffs to long-term contract auctions, particularly in Germany and France, now require RE producers to sell their electricity on the wholesale markets, whereas previously RE producers sold their MWh to the transmission grid or to the former monopoly which are obligated to buy them, under the RE producers’ priority access to the system. When this rule was abandoned, this increases the incentive for generators to participate efficiently in the markets after by programming maintenance in due time.

The cost of the schemes is paid by consumers, via a tax on the MWh consumed, but when the level of the tax becomes too high, the question of its acceptability arises. And governments may then be tempted to shift part of the payment to the public budget, especially when it is funded up by a carbon tax, as we see below.

2.4. The Long Term Contracts module

Comprehensive schemes including a procedure for programming capacity mix development and allocating long-term contracts through regular auctions have been introduced in some countries. They are established between investors and a public agency, or with a regulated counterparty that has an obligation to enter into long-term contracts in exchange for financial compensation for the cost of that obligation (the difference between guaranteed tariff and hourly market price) ((see Finon & Roques, 2013).

The addition of this module aims first of all to “de-risk” investments in production in all techniques, by seeking to guarantee revenues per MWh over the long term. It also aims at correcting the structural problem of disconnection of market prices aligned with short term marginal costs from the long-term marginal cost, that is the full costs of the equipment one chooses to install, especially those with high CAPEX, which is the main structural problem of the electricity markets in the long run. The theory in the textbooks considers that there is an alignment of the price signal emanating from the hourly markets with the long run marginal costs of the different technologies before constituting the optimal mix, without consideration for the cost structure of each technology, and for risks. Indeed this ignores the exposure to the market risks of high CAPEX equipment, while the markets are incomplete and therefore do not offer the possibility of hedging with forward contracts or futures.

To get around this obstacle, Latin American countries, the United Kingdom and Ontario have introduced such mechanisms of awarding long-term contracts guaranteeing a revenue per MWh over the long term to secure investments in all technologies, whereas in other countries, this type of mechanism is reserved only for RES technologies (see below the module RES & Decarbonisation). Contracts are signed with the system operator in Great Britain (National Grid) or with a public agency in Ontario (Ontario Power Authority), which plays the role of sole buyer. It should be noted that observation of the effects of this type of arrangement reveals a significant reduction in the cost of borrowing due to the elimination of price- and volume-risks that they allow (Hirth and Steckel, 2016; Newbery, 2019).

In Latin America, all the long-term contracts auctioned can be divided into energy contracts (Maurer et al., 2014), as in Chile and Peru, capacity contracts in Colombia (Harbord et Pagnozzi, 2012), and contracts that pay for both energy and capacity, as in Brazil (Tomalsquilm, 2012). They are concluded with distributors because the latter legally retain their retail sales monopolies for the vast majority of consumers in their service area, with the exception of large consumers of more than 1 to 10 MW. The tenders have led to a number of entries of independent producers without established customers, alongside distributors’ own investments in generation which are partially integrated.

2.5. Long-term governance

A body must ensure the steering of the evolution of the power mix according to the changes in the costs of the different electricity sectors and the anticipated demand growth, as well as to adapt it to unexpected effects. With regard to this steering by programming, we can speak of planning to characterize the long-term governance in this new regime, because this is what is involved when successive auctions are organized to develop capacities of technologies to the levels defined by programming. Newbery and Grubb (2019), who assessed the effects of the British Electricity Market Reform, refute this idea of central planning by arguing that the results are never certain, as they might be in an authoritarian planning or might be also in the investment plan of former public utilities. Beyond this question of semantics, the challenge with this type of governance is to limit the risk of bureaucratic trend in this type of long-term governance.

A key question concerns the respective responsibilities of the regulatory authority, the public planning agency, the system operator and the ministerial bodies; they are either in charge of the planning process or participants to the achievement of the long-term security of supply, and decarbonization mainly based on RES development. Independence from policy makers and the ability of these public entities to resist capture by vested interests are essential. But independence does not exclude the risk of bureaucratic drift, which is the case with public entities in charge of these long-term coordination mechanisms that are generally reluctant to take risks in terms of security of supply by pulling the capacity development by incentives such as a capacity mechanism. Therefore, following the bureaucracy theory, if the definition of the capacity adequacy objective is in the hands of the system operator, there may be a risk of “over-quality” with the definition of the reserve margin beyond what would be reasonable to achieve. Similarly, concerning the decarbonation objective that would be pursued essentially by the RES development, the public agency in charge of the energy transition policy would have interest in asserting high objectives to be reached by a given deadline in order to highlight its public interest mission.

A compromise must therefore be found between the assurance of greater revenue certainty for producers to invest, on the one hand, and the bureaucratic risk of overprotective and inefficient decisions, on the other. One way around this problem is to organise a multi-level decision-making process, coordinated by a special planning agency that organises auctions; it can use independent expertise and discuss with the system operator, the regulator and the relevant ministry. In the United Kingdom, the lost advanced country in this respect, is not there yet, but the planning process, which involves several bodies, is sufficiently pluralistic to be part of a check-and-balance process between the National Grid’s programming plan, the studies of various ministerial and parliamentary committees and the prospects of the regulator, the Office of the Gas and Electricity Markets (OFGEM). The latter decides on the auctions for the capacity mechanism and for the RES techniques based on the government’s programming (Figure 5)

Fig. 5. Office of the Gas and Electricity Markets (OFGEM). Source: https://www.google.com/search?q=United+Kingdom+Ofgem&tbm=isch&ved=2ahUKEwiwi

The planning and decision making process can also be non-centralized by adopting a configuration that avoids some of the pitfalls of central planning (Finon et Roques, 2017). In Brazil, long-term load forecasts are prepared by the distribution companies for their service area and then aggregated by the power planning agency. In Chile, the decentralized approach is based on obligations imposed on supplier-distributors to enter into long-term contracts with generators for their supply in order to guarantee the security of supply in their areas. These obligations lead to credible performance in terms of meeting contract commitments and, beyond that, the investments needed to keep up with growing needs.

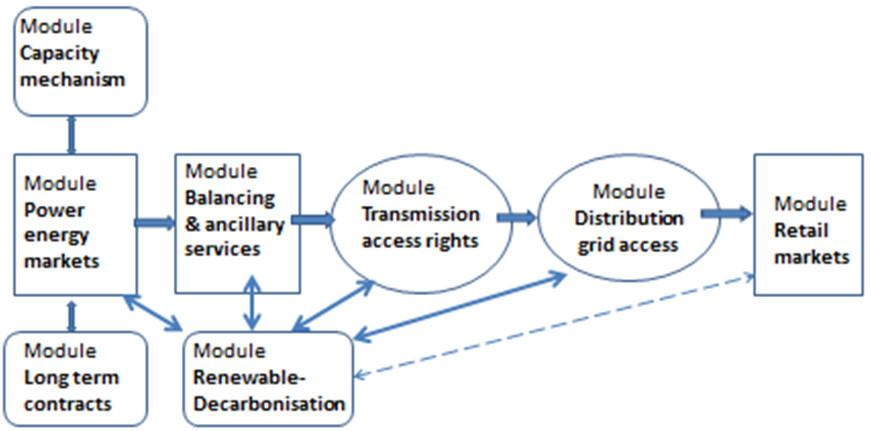

3. Tensions between old and new modules

In the new market design resulting from the addition of long-term modules, several problems emerge from interactions with the initial market modules. The “out-of-market” entries of low-carbon technologies with zero variable cost distort the long-term signal of the energy markets by leading to a decrease in the annual average price. Moreover, they lead to a very rapid growth in the need for energy balancing services and auxiliary services for system stability, which are expressed in the Balancing and System Services module and in the Transmission module, with redispatching around congestion points. As soon as the VRE productions reach significant shares of 15 to 20%, the VRE system costs become significant while the differences between the hourly market prices and the constant revenue per each MWh guaranteed to the VRE producers, (which is defined by the regulator by alignment on their cost) keep increasing. What are the ways of improving the market module and grid access one to limit these inter-module tensions (Figure 6)?

Fig. 6. Tensions between initial modules and long-term ones. The intensity of the inter-module tensions is marked by the thickness of the lines or, to a lesser degree, by the dashed line.

3.1. Tensions between the Markets module and the RES-Decarbonation module

In countries whose market design includes a vast Long-Term Contracts module that covers investments in every production technique, whether conventional or RES ones (as in Latin American countries), the electricity market completely loses its long-term coordination function. The search for the optimal mix leads to the development of a large share of low variable cost and high CAPEX technologies (hydroelectric plants, large-sized wind and solar PV plants), due to the large local resources. Entries of these low variable cost capacities tend to lower the average annual price of hourly markets, which reinforces the justification of hybrid model adoption in these countries.

In European countries and in some US jurisdictions the policies of which emphasize the development of RE, RES mecanisms are at the origin of almost all the installations of new capacities. It is therefore from the RE-decarbonation module that the tensions with the other modules come in first. In the Markets module, the average annual price falls as high variable cost generation is increasingly pushed out of the merit order by the VRE productions. When the share of VRE generation reaches approximately 40%, which implies that the installed VRE capacity exceeds the peak capacity, the number of hours during which the hourly power demand is covered only by VRE grows, resulting in zero market prices. A 2019 OECD-NEA exercise to optimize a West European power system under RES policy constraints calculated that prices would be zero for 1000 h/year when the share of RES production reaches 50%, and from 3000 to 3800 h/year with 80% (Cometto et Keppler, 2019). The electricity market thus definitively loses its long-term coordination function, with two important consequences for the market design.

Firstly, the use of these long-term arrangements to promote VREs and other low-carbon technologies, which is currently supposed to be transitory, until VREs become competitive, sees its justification reinforced by itself, even when the technologies are commercially mature. Even at €100/tCO2 and above, the carbon price would not be able to raise the revenues of RES and other low-carbon technologies sufficiently for operators to invest in such high CAPEX equipment on their own, on the basis of their net present value coming from future market prices that are seriously decreasing on average due to the growing presence of zero marginal cost RE.

Secondly, under the assumption that the policy imposes the development of VRE capacities at a certain level, market prices fail to signal scarcities, which disables it to lead to a new long-term equilibrium through the optimal development of the residual non-RES system. It becomes necessary to supplement the revenues of existing conventional equipment to limit closure decisions in order to maintain security of supply; the same is true for new flexible equipment and storage units whose installation would be necessary to back up the variable production of VRE units. This is a new argument for setting up an effective capacity mechanism (CRM) to complement the revenues of the new flexibility resources, not to mention the incentives that the CRM creates for postponing the closure of existing plants. A complementary solution is to improve the remuneration of flexibility services by deepening the balancing and system services markets.

3.2. Tensions between the RES-decarbonation module and the Balancing & System Services module

If countries opt for variable renewable energies independently of economic and environmental considerations, the integration of their production, after their large scale entry, which was carried out in a discriminatory manner with the other technologies, leads to more and more difficulties in adapting the system as their share increases. Apart from those with significant hydro capacity, existing systems are generally ill-suited to provide flexibility services at the level needed when the share of VRE generation exceeds the 20-30% level. Although new sources of flexibility,

– demand response in industry (load shedding),

– some pumping storage stations (see: Les stations de pompage (STEP))

– new interconnections with neighbouring systems that allow to take advantage of the non-correlation of VRE productions between systems,

the level of flexibility achieved by the European and American systems, which have few hydropower, are far from offering the level of flexibility required by an electricity system with a large share of renewable energy. This is evidenced in Europe by the growing number of episodes during which hourly prices are negative (Figure 7). They originate from poorly flexible power plants which prefer to operate during the hours of low residual demand before the hours when the residual demand will be higher, which would not exist in the future in a system after development of significant flexibilities. This is not a hypothetical phenomenon: indeed it is happening more and more frequently in Germany, where the total of current wind and PV capacities (40.7 GW and 49.6 GW respectively) is close to the peak demand of around 100 GW, and the number of such negative price hours was already 97 in 2016 and 134 in 2018.

The development of VREs reinforces the need to reward operational flexibility, especially as flexible equipment contributes to the guarantee of supply in critical periods which become not only located during demand peak periods due to randoms of VRE production. The solution to develop flexibility resources lies first of all in the incentives given by the market remunerations which can increase if we improve the Balancing-System Services module, but also the Capacity Adequacy module, as it has just been specified. In the case of storage, the flexibility value of the equipment emerges in two ways:

– through arbitration by playing on price variations according to scarcity or surplus on the two energy markets (day ahead and intraday), and through remuneration of system services,

– by the market mechanism that the Transmission System Operators (TSOs) must implement on access rights

New products with a high temporal granularity are created to allow TSOs to pay producers and storage operators who respond efficiently to the need to maintain system stability. Prices in these different markets reveal the value of different products and services on an hour-by-hour basis and, ultimately, can help drive investment towards flexible resources (IEA, 2016). Market rules should facilitate trading as close to real time as possible (e.g. through the introduction of electricity delivery contracts that allow electricity to be traded in 15-minute blocks rather than the previous one-hour blocks) and up to 45 minutes before real time (instead of 1 day before in real time).

This being said, despite all the possible improvements in market design, investing in a source of flexibility (gas turbine, battery or compressed air storage, load shedding) in order to make a profit remains fundamentally risky. Can an operator really anticipate the profitability of its investment on the basis of revenues from flexibility services markets and the value of arbitrages between low and high price periods? In addition to the volatility of prices on the different flexibility services markets, an operator will also face a fundamental uncertainty on its revenues, due to

– the unanticipated effects on energy prices and these markets of the development of renewable energies on the one hand,

– but also, to those of other operators’ investments in storage and aggregators of load shedding, which would not be coordinated in any way, on the other hand

The effect of German photovoltaic production development on how four pumped storage projects in Switzerland have been undermined by this production is often taken as an example, as it has reduced the spreads between daytime and night-time prices, while these projects would have found sufficient arbitrage value to be profitable without this development of photovoltaic equipment. Certainly it could be considered optimistically that after the learning periods, investors in storage will find the ways to hedge their risks and to cover their costs, as can be read in particular in the IEA’s “Repowering the market” (2016). But they will be painfully confronted to the reality of multiple intertemporal and geographic interactions inside the power system and would certainly not invest in storage anymore, unless specific subsidies mechanisms would be implemented.

This issue is crucial for European markets. The existing market designs there are both less detailed in terms of products than the US models and ill-suited to value flexibility and thus direct investments towards flexible resources. It is feared that the short-term price signals do not accurately reflect the scarcity value of operational flexibility. Fortunately, an effort is being made to improve the “flexibility products” markets (system service, etc). Moreover, there is a focus on increasing integration of markets between neighbouring systems, including intraday markets and balancing mechanisms, as evidenced by the focus of the new EU regulations of the 2018 Electricity Markets Directive (Commission, 2018). This evolution must be accompanied by an improvement in transmission pricing to account for increasing congestion in the grid, due to the dispersion of RE generation sources.

Although some argue that the remuneration on these flexibility markets is sufficient to allow the system to adapt to the flexibility needs generated by the large scale deployment of renewable energy production (IEA, 2014, 2016; Hogan, 2017), it is doubtful that this is the case. One measure that could facilitate investments in storage would be the possibility of long-term contracts with guaranteed revenues after auctions, in the same way as is done for renewable units, but the storage capacities to be auctioned at each stage must be carefully planned according to the production shares they will reach in the future. The scope of the Long Term Contracts module would then be extended to include flexibility resources. This is what is beginning to be done for storage in some US jurisdictions (Joskow, 2019) and could be envisaged in Europe if the debate on the rules governing state aid for the promotion of RES and low-carbon techniques were to open up to this issue.

3.3. Tensions between the RES-decarbonation module and the Grid Access module

In most countries, renewable energy equipment, which is developed mainly at the level of the high voltage part of the Distribution System Operators (DSOs)’ grid, is connected to them without any price signal indicating potential or existing congestions in the transmission-distribution system. The development of renewables units where resources potential is favourable is done without any link to the conditions of the grid in these places, which in some countries, such as the United Kingdom, Germany and Spain, is already leading to unscheduled flows and local or regional congestions with significant costs.

In all countries, the anticipated evolution of the electricity mix towards a majority of RES (mainly VREs) should lead to innovate in a better coordination of investments in the networks with those of decentralized generation units. This coordination, which would combine planning and the use of price signals of network access rights, would have to be extended to the implementation of flexible resources (storage, demand response by load shaving/shifting, gas turbines, among others), the location of which could avoid the appearance of congestions and wind production curtailment, while it will limit network investments. Moreover, as the electricity transition policies often emphasize the transition to a more decentralized system based on distributed generation, the regulation of distribution tariffs must evolve in phase with the pace of deployment of renewable energies and the change in the profile of the electricity system towards decentralization.

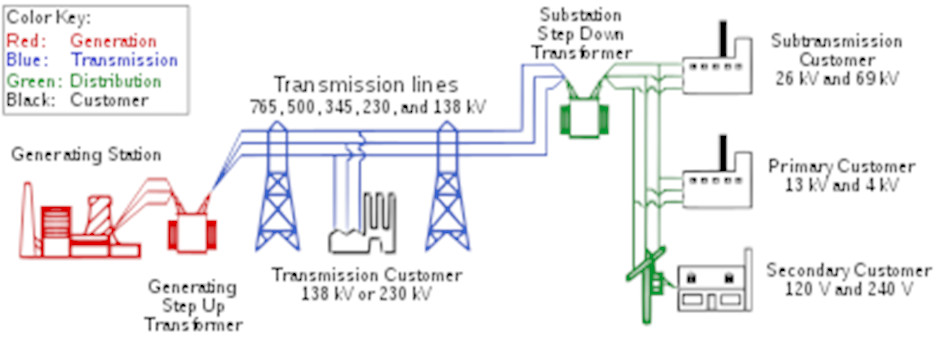

3.3.1. The deepening of the Transmission module

It follows that the Transmission module must be deepened both for congestion management and for better coordination of network investments with those in generation (Figure 8). In theory, in a logic of optimizing joint generation-network development, the balance constraints at each network node and at any time should ideally be translated into a specific energy price at each node that should signal scarcity and guide decisions of located equipment installation. It would be important for electricity and transmission prices to provide location signals that:

– in the short term, avoid congestion and minimize redispatchings,

– and, in the long term, provide incentives to locate new RES equipment and flexible resources in a socially efficient way, limiting the construction of new transmission and distribution lines.

There is a need to move from simple transmission access tariffs (“postage stamp” type) to nodal tariffs, or more modestly to zonal tariffs that are simpler to implement (Homberg et Lazariczyck, 2017). In zonal tariffs, the geographical scope of the system operator is divided into zones and prices are set for each zone by averaging the congestion cost of the nodes in the zone; it is then up to the system operator to carry out the right dispatching, the costs of which will be reflected in each zonal tariff.

Fig. 8. Electricity transmission. Source: Wikipedia, https://fr.wikipedia.org/wiki/Transport_d%27%C3%A9nergie_%C3%A9lectrique

This shift would be crucial to improve the efficiency of systems with a high share of VRE. Such a change is not self-evident, as the administrative and political costs are far from trivial, because there will be losers in any case. That said, if nodal or zonal pricing covering the variable part of the transmission cost allows VRE generators to bear the congestion costs for which they are responsible, it is much more difficult to make them bear the long-term network costs for which they are responsible, apart, of course, from the connection costs. One possible solution to limit costly investments in transmission and distribution networks is to implement, as in Ireland, a pricing system that encourages renewable energy producers to cut their production in congested areas (Brandstatt et al., 2011) or to give TSO and the local DSOs, the power to stop the injection of excess wind generation with various forms of compensation (Anaya et Pollitt, 2013). Without no compensation at all, VRE generators would be incited to invest in storage units.

3.3.2. Deepening the Distribution module

Transmission and distribution pricing must adapt to the need to give the best signals in a more decentralized world of distributed generation and consumers becoming active and price responding, whose arrival is desired politically in the liberal and market view. But the large-scale development of individual or/and community production of electricity based on renewable energies, especially solar PV, which will remain closely integrated into the electricity system, is not without raising economic issues of efficient pricing, especially for the power purchases of individual self-generators to the system for their residual power needs. This development towards decentralisation also opens up the question of energy, balancing services and system services exchanges at the level of the DSO’s system (MIT Initiative, 2017; Jenkins and Perez-Arriaga, 2017).

The distribution networks, from being “passive”, could become technically “active” like are the TSOs by their transformation into smart grids via the use of power electronics and digital technology (See: Des réseaux électriques aux smartgrids). With a smart grid, DSOs will be able to use balancing and system services offered by small-scale producers, including VRE generators, such as those offered by aggregators of industrial and domestic load shedding or electric vehicle charging, to ensure part of the balancing and stability of the general system on their respective networks.

This activation requires different progress in the regulation of distribution grids in several directions. In order to obtain a fair and transparent return on their investment in modernisation, it is already necessary to change the rules of incentive price cap or revenue cap regulation which de facto incites to limit expenditure. The unbundling rules also need to be relaxed to allow DSOs, like the TSO, to develop storage units to facilitate arbitration in the system between reinforcing lines or installing a storage unit, which the European Commission, in the name of its market competition grammar, was not and still is not in favour of

In some countries or jurisdictions, the evolution of systems towards decentralisation is even accompanied by the installation of market platforms at the level of each distribution system to ensure the supply-demand balances of flexibility services and system services at this level, and also to trade the surpluses or deficits of these services with the central system. In order to do this, the interfaces at the various technical connection points between the central system and the distribution systems at this level must be taken care of. Experiments in this direction are being developed in the United States, particularly in the New York State (NYPSC, 2017). Such a development, if it became widespread, would mean a spatialization of the Adjustment and System Services module.

3.4. Tensions between the RE-decarbonation module and the retail market module

Two problems arise when all market segments are open to retail competition:

– on the one hand, the inadequacy of selling prices, offered by suppliers to domestic and tertiary consumers, which do not pass on the volatility of wholesale prices resulting from the variability of VRE generation,

– on the other hand, the way in which consumers pay for the increasing costs of the VRE support mechanisms through a tax per MWh.

3.4.1. The interest of developing a dynamic pricing system

Despite the deployment of smart meters, most residential and commercial customers pay their suppliers with retail prices per kWh which do not vary from hour to hour because they are constant over pricing periods, given that the suppliers’ raison d’être is to take the hourly price risk on themselves. In short, retail price are disconnected from price changes in wholesale markets. With rigid retail prices, small and medium-sized consumers have little incentive to take action to control their demand in response to changes in these prices, as they might by using the inertia of air-conditioning, space heating or water heaters, when there are increased opportunities to modify the use of these devices by third parties (suppliers, aggregators) through their connection to the Internet. The development of dynamic pricing by competing suppliers can make these adaptation measures possible by monitoring fluctuating wholesale prices. But to attract customers to this load management, suppliers will probably have to try to offer them simple load shedding options, if aggregators do not take care of this

3.4.2. The tax to finance the RES support schemes cost

As the “out-of-market” development of VRE capacity continues, a gap is created between the continuously decreasing market prices and the average costs of the MWh produced by the system, reflecting the full costs of VREs’ MWh including their increasing system costs.

A large part of this gap is reflected by the difference between the prices paid to the RES producers through feed-in tariffs, or CfD-type contracts, which cover their full costs on one hand side and the market prices on the other hand side. This difference is most often financed by a specific tax paid by consumers. However, this tax tends to increase rapidly to reach very high levels, as shown by the German case: while the share of RE production is 28% in 2018, the tax (the EEG) is already €70/MWh, for a market price of €50 to €60/MWh on average. Future cost reductions of wind and solar PV technologies will probably moderate the growth of this tax in the medium term, which could even decrease for some time Agora Energiewende, 2019). But in the long term, i.e. around 2030 and beyond, the decrease of the average market prices will be inexorable with the growth of the number of hours of zero prices without an increase of the carbon price being able to really correct this effect, because, for a given share of RES production over one quarter-one third, this increase does not have any effect on the number of hours during which the prices will be zero

This leads to a problem of social acceptance of the VRE policy, which forces governments to react in three directions:

– reforming the revenue guarantee scheme(s) for RE producers to make it more cost saving for the consumers’ bill,

– capping the amount of annual spending or the capacities annually developed,

– change the way the cost of the schemes is financed.

In the first direction, feed-in tariffs have been replaced under the EU Commission’ injonctions in several European countries, including Germany, France and Italy, by auctions for the allocation of long-term contracts, which better reveal the costs of investors by the pressure of competition. In the second direction, the British government has put in place a procedure to control the total cost of low-carbon policy in the electricity sector through the definition of a spending cap over a given 20-year period. This capping approach leads directly to the withdrawal of support for certain technologies considered to be the most mature when the cap is approaching, as was the case in mid-2019 for small-sized onshore wind projects that benefited from feed-in tariffs.

In the third direction, the French government chose in 2017 not to increase the part of the public service charge for energy (the CSPE) on MWh intended for the financing of electric RE, which was €10 /MWh for a share of RE of 9% in the overall production in 2017, and to have the growth of the support schemes’ cost financed by the State budget, itself abounded by the carbon part of the fuel tax covering gasoline, heating fuel oil, natural gas, etc. (the TICPE).

It should be noted that the debates about the cost of the support schemes generally mark the beginning of a reflection on the economic rationality of the indefinite development of RES in the power, which could augur a progressive shift in RE policies in the future.

4. Recognizing the change in the sectoral regime

In conclusion, there is a need for explicit recognition of the change in the regime of the power systems in the OECD countries, in particular in the EU and the USA, which has already been done for a long time in Latin American countries and more recently in the United Kingdom. Paul Joskow recently regretted that in the US there is no explicit recognition that long-term coordination “must be done by a planner who decides how much and when to auction long-term contracts by technology, now including storage technologies (…)”, and that “markets for long-term and short-term operations (…) are now clearly separate” (Joskow, 2019, p.53). Such regrets should apply to the EU and its member states!

In 2020, we know that, in order to achieve the objectives of security of supply and decarbonisation, electricity markets must be complemented by public coordination of investments, including mechanisms for de-risking investments, based on long-term markets. This need is increased by the choice made by many States to favour renewable energies in their decarbonisation policy, which makes it necessary to deepen the market design and to improve the short-term coordination function of the markets so as to increase the offer of balancing services and system services in order to follow the increased needs for flexibility services of the system operator.

But it must also be recognized that political, cultural and legal contexts play a determining role in the possibility of these needed institutional developments. Firstly, the strength of beliefs in the virtues of competition which lead to a failure to recognise the specificities of the electricity economy,strongly constrain investment in high CAPEX technologies. This is particularly the case in the EU, where capacity mechanisms have met with hostility from the Commission’s Competition Directorate (Bruel, 2018). The same is true for contracts guaranteeing revenues to low-carbon and RE equipment, which are subject to very strict supervision under the state aid rules regime. (DG Comp, 2014; Genoese, 2016; Finon,2019). In the recent “Clean Energy for All” laws package adopted in 2019 (figure 9), it is not surprising that nothing is really allowed for Member States to steer the long term evolution of their energy mix by choosing their own policy instruments, or to support other low carbon technologies than RES. The only observable progress authorized by the “Brussels” Market tropism is a flurry of measures and regulations to develop PV self-production and decentralized sources of flexibility (load shedding, individual storage, etc.) on a market basis, and to imporve integration of flexibility markets (balancing, system services) in order to facilitate the economic integration of renewable energies in the systems.

Fig. 9. Clean energy for all Europeans. Source EC-Europa-EU: https://www.google.com/search?q=clean+energy+for+all+european+package&source=

Recognising the need to institute a programming function would be to recognise the pre-eminence of public regulation over the market coordination, contrary to the Brussels doxa. It would also mean admitting that the application of the principle of subsidiarity should be extended by delegating the function of electricity planning and the implementation of their programmes to the Member States. In order for this to happen, the heterogeneity of the policies of the Member States should not be considered by the EU Commission as an argument to block this desirable evolution a priori, under the pretext that this heterogeneity would be an obstacle to integration of markets or that it would make it difficult to develop efficiently trades between countries at high level, as if it were an end in itself. This would be to favour short-term regulation over the realisation of long-term objectives (security of supply, emission mitigation) that Member States could handle more efficiently on their own without the hindrances put by Brussels on the development of other low carbon technologies, namely the nuclear. It would also be forgetting that the renewable energy promotion policies of certain Member States as Germany have been independently decided without concern for the effects on the electricity systems and markets of other countries.

An explicit recognition of the necessity of the current regime change in the EU texts, would allow governments and investors to no longer have to permanently confront the formal rules limiting state aid and long-term contracts in the name of the sacrosanct Competition. More generally, the non-recognition or even the denial of such a change of regime can only be counterproductive, by making it more difficult to achieve the objectives of decarbonisation and security of supply, while the latter is made more delicate by the indefinite deployment of variable RES by long term public subsidisation. The use of risk sharing arrangements should be generalized to all generation technologies and flexibility sources. These would allow to significantly lower the cost of capital, and beyond, the overall cost of achieving the low-carbon transition by maintaining security of supply.

Table of acronyms

| CAPEX | Capital expenditures |

| CCS | Carbon Capture and Sequestration |

| CfD | Contract for Differences |

| CSPE | Public service charge for energy |

| RE | Renewable Energy |

| VRE | Variable Renewable Energies |

| DSO | Distribution Network Operators |

| TSO | Transmission System Operators |

| CRM | Capacity Remuneration Mechanism |

| MWh | Megawatt-hour |

| OCDE | Organisation for Economic Co-operation and Development |

| OFGEM | Office of the Gas and Electricity Markets |

| PV | Photovoltaic |

| RPS | Renewables Portfolio Standards |

| TICPE | Domestic consumption tax on energy products |

References

Agora-Energiewende, 2019. Die EEG-Umlagesteigt 2020 leicht an, der Kostengipfelistfasterreicht.https://www.agora-energiewende.de/presse/neuigkeiten-archiv/die-eeg-umlage-steigt-2020-leicht-an-der-kostengipfel-ist-fast-erreicht/

Anaya, K., Pollittt, M., 2013. Understanding best practice regarding interruptible connections for windgeneration: lessonsfrom national and international experience. EPRG WorkingPaper 1309. Cambridge University.

Baldwin C., Clark K., 2000. Design rules: The power of modularity. Massachusetts Institute of TechnologyPress: Cambridge MA.

Boiteux, M., 1949.The pricing of peak demands: Application of the theory of marginal cost selling. Revue Générale de I’Electricité, 58, pp. 321-340 (See: Électricité : l’orientation rationnelle des consommations par la tarification et Électricité : La vente au coût marginal)

Brandstätt, C., Brunekreeft, G., Friedrichsen, N., 2011, Locationalsignals to reduce network investments in smart distribution grids: whatworks and what not?BremenEnergyWorkingPapers, WorkingPapersseries 07

Bruel P., 2018, Le mécanisme de capacité, instrument économique de la sécurité d’approvisionnement en électricité, Revue de l’Energie, n° 641, Novembre-décembre2018.

Cometto M. and Keppler, J., 2019, The Costs of Decarbonisation: System Costswith High Shares of Nuclear and Renewables. NuclearEnergy Agency -OECD Report, Paris, OECD.

Cramton, P., Ockenfel, A., Stoft, S., 2013. CapacityMarket Fundamentals, Economics of Energy&Environmental Policy. 2 (2), pp. 27-45.

DECC, 2011. White Paper on planning ourelectric future for secureaffordable and lowcarbonelectricity. July 2011. Cm 8099

DG Comp (European Commission), 2014. Guidelines on State aid for environmental protection and energy 2014-2020, Communication from the Commission. Com 2014/C 200/01.

European Commission, 2016a. Proposal for a Directive of the EuropeanParliament and of the Council on the internalmarket in electricity. COM(2016) 861 final, SWD(2016) 413 final

Finon D., 2019, Electric Europe and the long term: the impossible mutation of the market regime? Revue de l’Énergie n° 643 – March-April 2019, p. 73-81.

Finon D., 2013, ‘The transition of the electricity system towardsdecarbonization: the need for change in the marketregime’. Climate Policy, 13 (S01), pp. 131-146

Finon, D., Pignon, V., 2008. Electricity and long-termcapacityadequacy: The quest for regulatorymechanism compatible withelectricitymarket. Utilities Policy. 16 (3), pp. 143-158.

Finon D., Roques, F., 2013, Europeanelectricitymarketreforms: The visible hand of public coordination. Economics of Energy&Environment Policy. 2 (2), pp. 107-122.

Genoese, F., Drabik E., Egenhoffer C., 2016, The EU power sector needs long-term price signals. CEPS Special Report No 135 (April).

Glachant J.M., Perez Y., 2009.” The achievement of electricitycompetitivereforms: agovernance structure problem?” In C. Menard and M. Ghertman (eds), Regulation, Deregulation, Reregulation – Institutional Perspectives. Cheltenham: Edward Elgar.

Hirth L., Steckel C., 2016, The role of capital costs in decarbonizing the electricity sector. Environmental Research Letter, 2016, n°11

Hogan M., 2017, Follow the missing money: Ensuringreliabilityat least cost to consumers in the transition to a low-carbon power system. The Electricity Journal, 30 (1),p.55-61

Holmberg P. ,Lazarczyk E., 2015, Comparison of congestion management techniques: Nodal, zonal and discriminatorypricing . The Energy Journal, vol 36, n°2

IEA (International Energy Agency), 2016. RepoweringMarkets. OECD publishing: Paris

IEA (International Energy Agency) . 2014 .The Power Of Transformation -Wind, Sun, And, the Economicsof Flexible Power Systems. OECD publishing: Paris

Jaffe A., Newell R., Stavins R., 2005. A tale of twomarketfailures: Technology and environmentalpolicy, EcologicalEconomics, 54(2-3), pp. 164-174.

Jenkins J. , Perez-Arriaga I., 2017, “Improvedregulatoryapproaches for the remuneration of electricity distribution utilities with high penetration of distributedenergyresources”.The Energy Journal, Vol. 38, No. 3, pp. 63-91.

Joskow P. , 2019, Challenges for WholesaleElectricityMarketswith Intermittent Renewable ,GenerationatScale: The U.S. Experience. MIT-CEEPR WorkingPaper No. 2019-001

Joskow, P. 2008. “Capacitypayments in imperfectelectricitymarkets: need and design”. Utilities Policy. 16, pp. 159-170.

Joskow, P., Schmalensee, R., 1983. Markets for Power. MIT Press: Cambridge, MA.

Keppler J.H., 2017, “Security of supplyexternalities and asymmetricinvestmentincentives in markets for non-storablegoods: the case of capacityremunerationmechanisms”. Energy Policy, vol.105.

Lehmann, P., Grawell, E., 2013. Whyshould support scheme for renewableelectricitycomplement the EU emissiontradingscheme? Energy Policy. 52, pp. 597-207.

Mastropietro, P., Batlle, C., Barroso, L.A., Rodilla P., 2014. Electricityauctions in South America. Renewable and SustainableEnergyReview. 40, pp. 375-385

MIT Initiative, 2017. Utility of the Future, An MIT Energy Initiative response to an industry in transition. Cambridge, Mass

Mitchell, C., Bauknecht, D. 2006. Quota’s versus subsidies: Riskreduction, efficiency and effectiveness. A comparison of the Renewable Obligation and the GermanFeed-In law. Energy Policy. 34 (3), pp. 297-305.

Moreno M., Barroso, L., Rudnick, H., Mocarquer, B., Bezerra, B., 2010. Auctionapproaches of long-termcontracts to ensuregenerationinvestment in electricitymarkets: lessonsfrom the Brazilian and ChileanExperiences, Energy Policy, 38 (10), pp. 5758-5769.

New York Public Service Commission, 2017, Reforming: the Energy Vision Initiative.

Newbery D., 2019. Strengths and Weaknesses of the British Market Model. Cambridge WorkingPapers in Economics No. 1917

Newbery, D., 2011. Reforming CompetitiveElectricityMarkets to MeetEnvironmentalTargets, Economics of Energy&Environmental Policy, 1 (1), pp. 69-82.

Newbery, D. , Grubb M.. 2018, UK Electricity Market Reform and the Energy Transition: Emerging Lessons.CEEPR-MIT working paper no. 2018-004.

NREL (National Renewable Energy Laboratory), 2014.A Survey of State-Level Cost and Benefit Estimates of Renewable Portfolio Standards. Technical Report, NREL/TP-6A20-61042, May 2014.

Roques F., Finon D., 2017, Adaptingelectricitymarkets to decarbonisation and security of supply objectives: Toward a hybridregime? Energy Policy. Vol. 105C, pp. 584-596.

Roques F., 2011.” The role of long termcontracts in pure producer’s portfolio approach of generationequipment”. In: Glachant, J.M., Finon, D., Hauteclocque (Eds.), Competition, Contracts and ElectricityMarkets: A New Perspective. Edward Elgar: Cheltenham (UK). Chapter 2.

Roques, F., 2008. Market design for generationadequacy: Healing causes ratherthansymptoms. Utilities Policy. 16 (3), pp. 171-183.

Tolmasquim, M., 2012. Power SectorReform in Brazil.Synergia Editora: Rio de J.

The Brattle Group, 2014. Resource AdequacyRequirements, ScarcityPricing, and ElectricityMarket Design Implications.

Wiser, R., Namovicz, Ch., Gielecki, M. and Smith, R., 2007. Renewables portfolio standards: A factual introduction to experiencefrom the United States. LBNL-62569. Lawrence Berkeley National Laboratory: Berkeley, CA.

Summary

The re-emergence of public interventionism in electricity markets raises questions as to how market design can best be adapted to meeting the investment challenge associated with security of supply (SoS) and decarbonisation objectives. The move towards a hybrid market regime, which relies on a combination of planning, long-term risk sharing arrangements and improved markets, appears to be unavoidable where decarbonisation policies are adopted besides the crucial objective of SoS. This paper argues that a number of additional building blocks is required to achieve these long-term policy objectives. Ultimately, this hybrid regime, the most complete form of which is found in the United Kingdom and Latin America, is based on two forms of regulation: 1) planning combined with a competition “for the market” for the development of new capacities in different techniques and 2) competition “on the market”, limited to economic dispatching.

This paper has been published in French in the Revue de l’Energie, n°647, pp. 34-52, nov/dec 2019 under the title « Secteur électrique : du régime de marché à un régime hybride planification-marché ». It is reproduced in english with the permission of the Revue de l’Energie.

[1]Recent experiences with capacity mechanisms are diverse in the EU. A number of Member States have adopted limited mechanisms such as capacity payments (Spain, Greece, Ireland, Portugal) or strategic reserves (Germany, Belgium, Finland, Sweden), which only deal with part of the problem, i.e. keeping conventional power plants in operation (Bruel, 2018).