The rise of intermittent renewable energies (VRE) encourages the development of new intersectoral couplings Power to Gas and Power to Heat. Their potential development encounters many obstacles because the very capital-intensive techniques they use are only profitable with a high rate of use which is completely dependent of low electricity prices period in power systems with high shares of VRE. Overcoming these obstacles requires strong energy governance with planning and support with long term de-risking arrangements.

The prospects opened up by the possibility of sectoral coupling were highlighted (Part 1) by the successive review,

- of the different ways of electrification of uses and the different sectoral couplings Power-to-Heat (P2H) and Power-to-Gas (P2G) links [1];

- the electrification of heat uses, via heat pumps in industry and district heating (DH) compared to established techniques, conventional boilers and cogeneration, some of which are powered by renewables energies RE (biomass or geothermal energy, among others);

- the different techniques of production of hydrogen and synthetic methane in parallel with other green gases, for which the development challenges are considerable.

But are these couplings as simple to make, given the risk management on capital-intensive investments to be made under market conditions and the regulatory obstacles they would face? In response, the protagonists of couplings have begun to reflect on the incentives to be put in place and on the removal of obstacles to such integration so that all primary energy sources and all associated carriers can compete on an equal footing at each level of the value chains and at each intersectoral node. Such developments would require a strengthening of energy governance at local, regional and national levels with significant planning and financing resources. Such an option is in sharp contrast to competition principles and the dominant market culture in the European Union (EU). It inevitably creates uncertainty about the chances of a successful transformation of every European energy system.

Different issues should be raised on:

- the main constraints and regulatory and institutional limitations on the competitiveness of the P2H and P2G couplings,

- the policies and measures that would need to be implemented to make such forward-looking options possible and operational ;

the need for strong governance at all levels, from local to regional and to national, which implies coordinating the development of intersectoral projects between each levels, against the general market coordination supposed to be the most efficient.

1. Hurdles on economic development of sectoral couplings

Several studies suggest that there are advantages to closely link sectors. That of Deutsche Energie-Agentur (DENA), the German energy agency, on the possibility of the entire energy system achieving carbon neutrality by 2050, points out that “scenarios that focus solely on large-scale electrification would be more costly than those based on a very diverse mix of energy technologies with multiple cross-sectoral couplings (Figure 1). The difference is so large that the scenario of large-scale technology mixes that would allow a 95% greenhouse gas (GHG) reduction would be less costly than a large-scale electrification scenario that would only allow a safe 80% GHG reduction. The main reason for the difference is a sharp increase in investment costs “.

Others estimate that “for Germany, a sectoral coupling scenario would lead to an annual saving of 12 billion euros or a cumulative saving of 268 billion euros by 2050, compared to a purely electrical scenario” [2]. The prospective scenarios of these studies are based on economic evaluations of P2G and P2H options that highlight the importance of differences in taxation between energies on the results. These evaluations are also closely dependent on two types of assumptions: those of the cost reductions of the technologies that will have to be confirmed and, upstream the processes, those of the hourly prices of the power market with a high share of VREs over the year under consideration. These hourly prices depend on the production shares of the latter ones: the greater the share, the greater the number of hours with low or zero prices [3].

In a NEA-OECD exercise on the long-term optimisation of the power system under the constraint of VRE development [4], it can be seen that prices are zero over an increasing number of hours: 1000h/year when the share of VRE production reaches 50%, and 3000 to 3800h/year with 75 to 80% of VRE production [5]. It follows that the average annual price decreases as the production shares of intermittent renewable energies increase.

1.1. Finding the right balance between the development of VRE and sectoral couplings

The P2G and P2H evaluation exercises do not agree on the minimum load factor for green electricity to hydrogen conversion by electrolysis to be economically viable [6]. The most optimistic are advancing at least 3,000 hours/year, which already requires about 75% of the electricity production by VRE in the power system. Others exercises find that it would need at least 6,000 hours/year with a very low electricity price, i.e. almost all the electricity would be produced by VRE. The same applies to the costs of producing synthetic methane by the electrolytic H2, where the investment costs along the chain per MWh of gas produced are very high, whereas the efficiency of the chain is quite low (currently 55%).

In any case, reference studies paint an optimistic picture of the economics of the P2G and P2H processes, but they supposd a perfect world, with no uncertainty, no unexpected effects and in a perfect information framework for the future. They perfectly anticipate the decrease in the costs of the different processes as well as the advantages and disadvantages of the different solutions; they also consider that all the positive externalities of individual decisions (such as the learning effects on the costs) can be passed on the income of the decision-makers. In the real world, especially when it comes to decisions to invest in capital-intensive equipment with long payback periods, the reality is quite different.

Added to this are dynamic interactions between investment decisions made by various players at different points each coupled sector, which play on the economic value of new assets with unexpected effects. Two examples illustrate this:

- Investors in pumped storage may face a reduction in the value of their equipment to be developed if solar PV production increases at the same time, as this will reduce the day/night price spread that investors expect in order to generate an arbitrage value sufficient to make their project profitable.

- Dynamic interactions also create difficulties in assessing the profitability of coupling equipment in P2G or P2H, while evaluation exercises conducted by P2G and P2H protagonists do not take these interactions into account, such as the raising price effect of the deployment of P2G or P2H, on the hourly electricity prices when VRE production would have been on surplus on demand [7]. This effect makes better profitability for new VRE equipment, but, in parallel, the result is a loss of competitiveness of the H2 produced by P2G electrolysers, as well as heat from large heat pumps in industrial heat uses or for the concerned district heating system. These unexpected effects, which create uncertainty, are hardly appreciated by financiers, as they know that they are difficult to anticipate in their risk analysis for investors.

1.2. Correcting regulatory barriers

Institutional or regulatory barriers and physical limitations of existing network infrastructure will hamper the deployment of intersectoral coupling. However, the situation differs from one country to another depending on the presence of district heating networks or a dense gas grid outside urban areas, as density facilitates the connection of local production units of green H2, synthetic natural gas or biogas [8].

In most countries, with the exception of cogeneration in district heating systems, electricity, gas and district heat are traditionally based on separate infrastructures without a combination of carriers (Read: District heating networks). As trade of each energy carrier is governed by separate regulations and tax regimes with varying differences, the objective should therefore be to create a level playing field between carriers, eliminating distortions between energy sources at every possible point of connection from one sector to another.

Electricity is generally taxed more than other energy carriers, which is a concern for the use of heat pumps in district heating networks (Figure 2), due to the lower taxation of fuels used in district boilers, as well as for the supply of P2G electrolysers, compared to the conventional production of H2 by steam reforming of natural gas, which is less taxed, with the same energy content.

Fig. 2: Launch in September 2017 of the Interreg France-Switzerland PACs-CAD project (district heating network). [Source: University of Savoie Mont Blanc]

In terms of taxation, it would also be advisable to reorganise the different charges on electricity or gas sales which are dedicated to finance the electricity or gas renewable subsidy schemes, such as a major part of the Contribution au service public de l’électricité (CSPE) in France, the Erneuerbare Energien Gesetz (EEG) in Germany or the Green Levy in Denmark. Producers of green H2 from electricity purchased during periods of hourly VRE surplus should be exempted from the payment of the green levy because their aim is to produce a decarbonized carrier. The same would apply to electricity used by large heat pumps in district heating and industrial heat uses.

One could also go further by redesigning the transmission tariffs on electricity to electrolysis or to heating heat pumps in DH system or in industry, to take into account the particularities of the use of electricity coming from the VRE production surpluses for its transformation into H2 or heat during periods of low hourly supply/demand tensions. Reductions in electricity transmission rates to the electrolysers would be justified by the economic advantages for the power system operation by valuing MWh in surplus. On the side of gas transportation rates, one could also take into account the benefits that injection of RE gas from local producers can offer for the management of local distribution networks, by reducing their injection rates at those level.

Going even further, one could seek to improve the market designs of the electricity and gas markets to facilitate the coupling between these two markets in order to promote flexibility in both systems by aiming to improve the arbitrage value of P2G and P2H equipment, one of their roles being to allow arbitrages between the hourly markets of each sector.

2. Improving public policies

Various policy instruments can also be used to encourage the development of coupling technologies over the medium and long term. In general, to bring green H2 costs closer to brown H2 produced from natural gas prices, efforts should focus on:

- reduction of the costs of electrolyzers and methanation units by improving conventional processes, process efficiency as materials to reduce maintenance cost,

- the development of competing processes of electrolysis : Proton Exchange Membrane (PEM) or Solid Oxide Electrolysis Cell (SOEC) processes at high temperature [9];

- the search for lower costs by learning effects that may result from “technology pull” through long-term subsidy schemes that could lead to the deployment of the techniques with series effects on the cost of electrolysers produced on a larger scale;

- a shift in unit sizes from 1 to 10 MW with significant size-effects of cost reduction..

Support mechanisms that can guarantee investors’ revenues in high CAPEX equipment in P2G and P2H should also be used to eliminate risk exposure to volatile prices of electricity and gas markets, especially to long-term uncertainties. One thinks in particular of the unexpected effects of parallel developments in VREs, flexibility sources (storage) and inter-sectoral couplings P2G and P2H, as mentioned above. These are of two types:

- green gas feed-in tariffs (H2, biomethane, in particular) purchased by obligated grid operators, their cost being reimbursed to them afterwards by resources from a green tax or the public budget ;

- long-term contracts with a public agency, that guarantee investors’ revenues per MWh (such as contracts for differences which are symmetrical options contracts), whether in electrolysers, methanation units or large heat pumps.

In both support mechanisms, long-term revenues guarantees make it possible to reduce the cost of capital, which can, for example, drop from 9% to less than 5%, which is an important advantage for financing investments in equipment with high CAPEX and reducing the complete costs of production. Moreover, these contracts can be awarded by auction to create competitive pressure, with beneficial effects of lowering the prices charged for the awarded contracts, which is already observed in the auctioned contracts for VRE projects in European countries.

Launching successive tenders to achieve generation targets is a good way to control the costs of the transition policy (Figure 3). Tenders can be based on a reference purchase price which is used to size the budget envelope. If the selected projects exceed the budget envelope, the reference purchase price proposed in the tender can be lowered to eliminate projects whose bid prices are over the new reference purchase price in order to respect the total budget envelope.

The interactions between these policies and those aimed at promoting electric VRE should however be taken into account, as the former will raise electricity market prices. As previously mentioned. The tax paid by electricity consumers to finance the VRE subsidy schemes could be reduced if P2G and P2H subsidy schemes were implemented [10]. This would provide additional justification for these schemes to reduce the cost of subsidies to VRE.

Another type of instrument is a “green gas” obligation to be imposed on gas suppliers. Proactive transition policies based on renewable gas seek to follow the same political logic as the development of green power production, by setting a binding target for the share of green gas to be reached at successive horizons. This is the impetus that the 2019 Gas Directive which aims to achieve a 10% share of green gas by 2030, is intended to give. This approach will logically lead to the adoption of an incentive scheme assigning an obligation for an increasing share of green gas in the purchase portfolio of gas suppliers, despite its redundancy with green gas subsidy schemes.

It can be objected that this obligation will be combined with exchanges of green gas certificates between suppliers, that will reduce the cost of the obligation. This was already advanced in the 1990s for the green electricity obligations adopted in the United Kingdom, Sweden, Italy and Belgium. But 20 years later, the British and Italians abandoned this scheme because it was more costly than feed-in tariff-type schemes, too difficult to pilot to send a credible price signal by the certificate market price, and, in the end, much less effective than feed-in tariffs in achieving the same target of renewable installations, or the same objective of reducing emissions through the development of VREs.

It is therefore regrettable that the EU is in the process of imposing an increasing obligation of green gases (biogas, biomethane, green hydrogen, synthetic methane) which should result in an obligation imposed on gas suppliers. It should increase from 2% in 2022 to 10% of gas fuel demand (measured in TWh) in 2030. Such a binding quota system will facilitate the development of green gases, in particular those from P2G, but it is uneconomical if it is superimposed on feed-in tariff schemes or revenue guarantee contractual schemes mentioned above. It is worrying to note that the question of its cost is not raised, whereas the CO2 emissions avoided cost by this development of green gases should be very high compared to other means of reducing emissions. This is one of the many biases of the EU’s transition policy design, both imbued with the market paradigm and systematically using of binding quantitative targets, whereas these two approaches ignore the existing carbon price which is supposed otherwise to trigger low carbon investments in power generation.

3. To have a stable and predictable regulatory framework

When considering the possibilities of developing P2G with green hydrogen produced by electrolysis to fuel various uses, it is expectable that this green hydrogen is far from being competitive with “grey” hydrogen from the steam-reforming of natural methane, and also with natural gas in other industrial uses, even hampered by high carbon prices. In order to reduce the cost of this green hydrogen and synthesis gas, electrolysers should be large-sized and to be built in series to benefit from size effect and then series effect. This would require a stable regulatory framework based on long-term subsidy schemes to trigger P2G deployment. This dynamic scheme concerns investments in all new coupling technologies such as large heat pumps, PEM electrolysers, high-temperature SOECs and methane pyro-gasification, among others.

For the necessary investments to be encouraged in this way, these types of incentive need to be reliable and financially predictable so that new business models can emerge. Desirable technological and industrial developments will not materialize without clear political and economic signals to be sent, based on innovative regulations. Concretisation of desirable evolutions towards green gas system and hydrogen economy through P2G channels, and those towards the greening of urban and collective heating systems partly by P2H deployment, implies not only strong political will at the central level, but also relays at the local and district levels by actors strongly committed and equipped with regulatory powers and financial means. This is idealised in “hydrogen cities” design or else in integrated installations design with RES installation for hydrogen production at service stations for sales (Figure 4). But it is also what can be achieved in a more secular way with district heating system exclusively based on biomass and P2H.

That said, in order to achieve an “integrative” energy transition based on multiple and diverse sectoral couplings, actions at each spatial level are important, starting with that of local authorities, when they can rely on their own distribution networks they eventually co-manage with industrial players, and when they are committed to developing local energy resources. The extension and reinforcement of networks to connect P2G production sites to gas distribution networks, or biogas-fuelled power units to electricity distribution grids must be planned at the level of local areas jointly with centralised grid systems.

As a result, well-coordinated planning between local and central levels is crucial for the efficient development of sectoral couplings (Read: Hybridization of Electricity Systems: The Benefits of Hydropower). Adequate development of local infrastructures has an important impact on the possibilities of deploying P2G or P2H equipment. Similarly, before making an investment decision in these directions, companies will need to consider the possibilities of connecting local renewable energy sources to both electricity and gas grids. In fact, the territory appears to be the ideal level for intersectoral couplings. This is particularly the case when energy actors already exist at this local level, such as district heating company, municipal distributors or even the newly energy communities. At the regional level, there are also opportunities to mobilise actors around the use of renewable energies whose potential can be shared between medium-sized city and surrounding rural areas.

Moreover, over the last two decades, local and regional reference points have developed with local and regional climate-energy plans in European countries. These reference points have already resulted from local cooperation between network companies and local authorities. They have stimulated and should further stimulate implementation of local actions, which, when aggregated, should constitute a significant part of the desired integrative energy transition effort. This underlines the need to strengthen energy governance at different levels, one of the aims of which would be to develop intersectoral couplings. From this point of view, lessons can be drawn from the failures of past policies to promote cogeneration coupled with district heating, which were a strong element of the energy policies of the 1990s. A report by the International Energy Agency (IEA) shows that, apart from funding constraints, barriers to large-scale penetration of this coupling technology were mainly related to a lack of strategic planning of heating and cooling infrastructure and a lack of long-term visibility of policies in this field [11]. The report suggests to develop strategic planning at local, regional and national levels for heat and cooling, based on accurate mapping of local heat demand and supply sources. This would be essential to identify in a coordinated way the opportunities for the development of cogeneration and the expansion of district heating networks, in order to ensure the profitability of localised investment operations. This is the crux of the matter.

That said, we are at the heart of a major contradiction in the European Union between the idealism of pursuing carbon neutrality and the dominance of the market culture within the European Commission and national administrations. The latter tends to prevent any reflection on the need for planning and close coordination between players, between sectors and between different spatial levels. This observation leads to perplexity about the implementation of integrative transition policies based on inter-sectoral couplings, as long as energy governance at all levels is not strengthened. Genuine planning, combined with mechanisms for public authorities to take on investment risks in large CAPEX equipment and infrastructures, should replace market signals in order to trigger investment decisions, which is far from the spirit of European laws and treaties focused on the market and free competition, in particular in matter of State aids. A radical change in the European legal framework would be needed. Without recognition of the central role of planning as a necessary mode of coordination of the actors in the transition, the desired integrative developments will be blocked unless there are dramatic revisions of Brussels doctrines.

Annexes

Annex 1

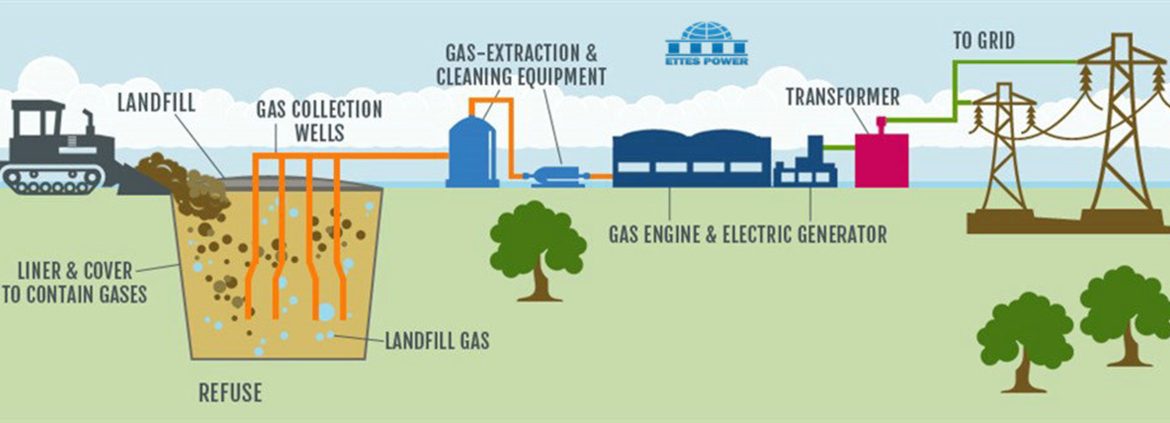

The P2G processes for the production of electro-green gases [12]

———————————————————————————-

1. Hydrogen production processes by electrolysis

Alkaline electrolysis

This is the dominant process. This first technology uses a potassium hydroxide (KOH) solution as electrolyte. Alkaline electrolysis offers a low investment cost compared to other electrolysis technologies, in particular due to the simplicity of the materials. Already benefiting from efficiencies of 68 to 77%, alkaline electrolysis has a limited margin for improvement and low reactivity to power variations. The prospects for improvement of this technology lie in manufacturing costs, operating pressure and conditions for coupling to intermittent energies. Depending on the capacity of the electrolyser and the pressure of the hydrogen supplied, the energy efficiency of the equipment varies between 66% and 74% (4.8 and 5.4 kWh) and the installed CAPEX varies between €1,000 and €2,000/kW. A cost reduction can come from the increase in the size of the installations, volume effects associated with market growth (the envisaged reduction is 10 to 20% of the cost price).

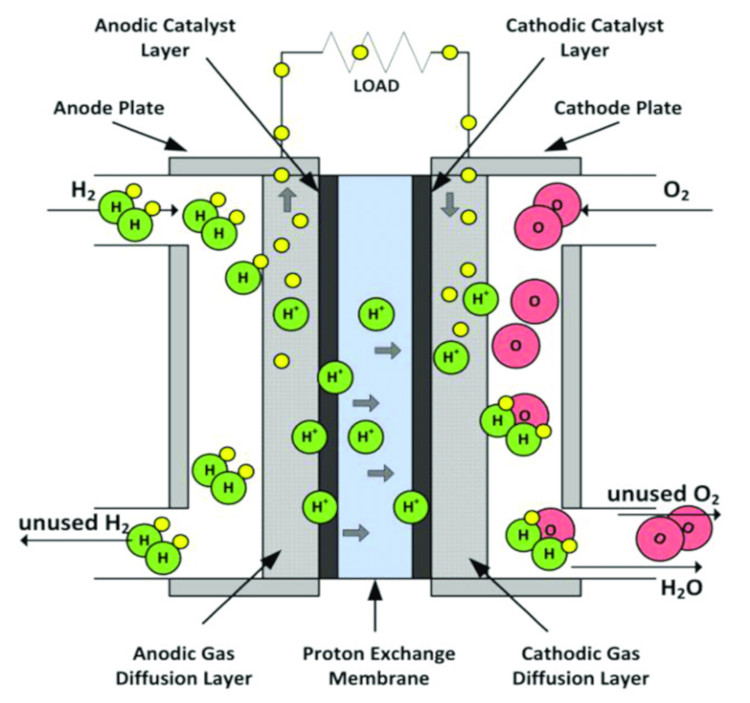

PEM electrolysis

It uses a polymer membrane (PEM for Proton Exchange Membrane) as electrolyte (Figure 5). This switch to a solid electrolyte significantly reduces maintenance and servicing costs due to the effects of the liquid electrolyte on the plant, as well as the compression of the hydrogen output. In addition, PEM electrolysis offers an excellent solution for distributed generation, thanks to a better reactivity to power variations as well as a high compactness of the system. The use of noble materials, particularly platinum, the life of the membranes and the limitations in the size of the assemblies are the main obstacles encountered. The current costs of PEM electrolyzers are about double those of alkaline technologies.

The development of the technology could, however, reduce investment costs below alkaline technology due to the higher compactness and pressurisation capability of the battery. Some reductions in CAPEX have already been achieved by reducing the content of rare materials in the membranes. Research and development (R&D) is now focusing on increasing the membrane surface area, cell stack throughput and the mutualisation of auxiliaries.

High temperature electrolysis

The increase in temperature during an electrolysis reaction leads to the removal of noble catalysts (platinum or iridium) and less electrical energy to be supplied to reach the decomposition threshold, which greatly reduces investment and operating costs. The main high-temperature electrolysis technology is the Solid Oxide Electrolysis Cell (SOEC). Operating between 700 and 900°C, SOEC electrolysis has a similar feature to PEM electrolysis. It is at the laboratory stage in RD&D. The main interest of the SOEC technology is the higher efficiency of the electrolysis process (typically 80 to 90%) and the possible use as a fuel cell in reverse mode.

2. Hydrogen methanation

Methanation refers to the synthesis of methane by hydrogenation of carbon monoxide or carbon dioxide. This reaction can be done by two different techniques: catalytic methanation or biological methanation. The catalytic option is the subject of research and development due to its current importance in the industry. Biological methanation is an emerging alternative to the catalytic option, with interesting prospects for cost reduction, but it still faces challenges in scaling up. Both routes are described below.

Catalytic methanation: this is a thermochemical process operating on a catalyst at high temperature (between 200 and 700°C) and pressures between 1 and 100 bar. The reaction is highly exothermic and the temperature must be controlled to avoid thermodynamic limitation of the reaction and degradation of the catalyst. In large-scale industrial applications and for continuous operations, this is achieved by a series of fixed bed adiabatic reactors and cooling the flow between each reactor. However, because P2G processes are implemented on a smaller scale, with intermittent operations, adiabatic reactors are not suitable. Other types of reactors such as fluidized bed reactors, three-phase reactors or structured reactors are being studied for this purpose but have not yet reached maturity. The investment estimates for a methanation unit used downstream of an electrolyser unit are very variable: 400-1500 €/kWth of synthetic methane at the investment.

Bio-methanation of green hydrogen. Biological methanation produces methane from hydrogen and carbon dioxide using methanogenic micro-organisms as biocatalysts. The reaction takes place under anaerobic conditions in aqueous solution, at atmospheric pressure or under pressure, between 20 and 70°C. It has the potential to significantly reduce costs through simple reactor design and low pressure and temperature conditions. However, several obstacles still need to be overcome. The Biocat project (Denmark), which is now the most advanced and is being developed beyond the engineering phase, aims to test the technology under real conditions (raw biogas and pureCO2 flow) with a 1 MWel electrolyser and a biological methanation reactor.

Appendix 2

The economic evaluation of Power to Gas

—————————————————————————-

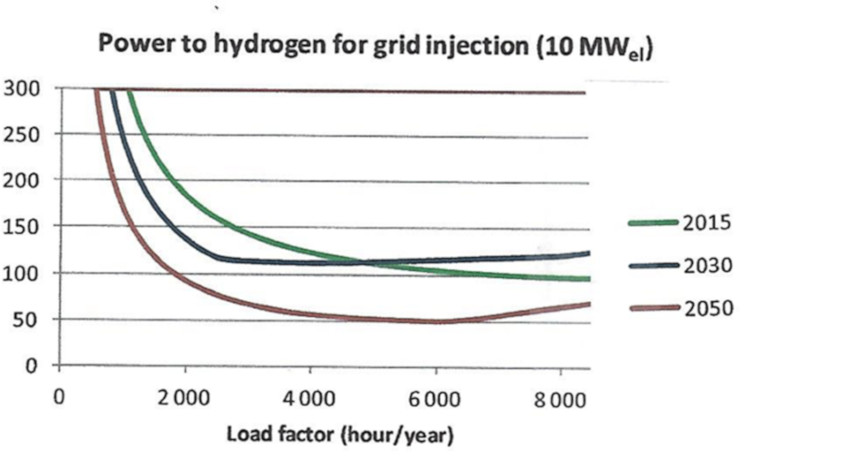

Reference is made here to ENEA’s study “The potential of power-to-gas” (2016) on Power to Gas. This study, like the P2G competitiveness studies, compares the cost of the final product with the price of conventional products on the target market, for example that of industrial hydrogen produced by steam-reforming, or that of injectable biomethane, which would compete with green H2. The competitiveness of green H2 or synthetic natural gas (SNG) depends on three main parameters:

- the level of investment costs for electrolysers and methanation,

- the process performance at the date in question,

- the hourly price levels of the electricity markets in the annual sequence on that same date, which will condition the rate of use of the two facilities.

Hourly electricity prices are decisive for the utilisation rate of the electrolyser and the methanation unit. Tests are therefore carried out at different horizons to define a scenario of annual hourly prices at each horizon, which will reflect the share of VRE in total production. For the 2030 and 2050 horizons, the prospective electricity price scenarios are based on the results of models that simulate the penetration effects of RE in the power system.

Three other parameters can still influence the results depending on whether or not they are considered: electricity taxation, the inclusion of electricity transportation costs and the cost of connecting to the gas network.

Two of the cases studied by ENEA are considered, the case of a large electrolyser with a capacity of 10 MWe, which is connected to the natural gas transport network, and the case of an electrolyser connected to a catalytic methanation unit to produce synthetic natural gas (SNG). Both must compete with the fossil methane in the grid (Figure 6).

Fig. 6: Profitability of green H2 production as a function of electrolyser charge factor (in €/MWh) [Source: © ENEA.2016, p.26]

In a case of hydrogen production from a 10 MWe electrolyser, the cost price would be between 110 and 125 €/MWh of gas depending on the installed P2G capacity. This compares to the current NG price of 30-40 €/MWh, with electricity supply accounting for 75-80% of the costs. The level of the cost is explained by the low utilisation rate of the electrolyser at that time when VRE’s share of electricity production cannot exceed 40%.

In the case of the electrolyser-methanation unit chain, even with untaxed electricity, the cost price of synthetic methane in the 2030 scenario is very far from the competitiveness zone with a cost price of €170-185/MWh. The cost price of the synthetic methane thus produced is much higher than that of the green H2 produced for injection into the gas network. This is explained by the increase in the total CAPEX for the production of one MWh of gas and the reduction in energy efficiency due to the additional methanation step (63% for electrolysis, 55% for methanation and electrolysis). However, in the 2050 scenario, with a lower investment cost and a greater number of low hourly electricity prices, the cost price could fall to 95 €/MWh without electricity tax, which would be close to what could be expected at that date from the price of fossil natural gas.

Bibliography

General approach

ADEME, (2018). Trajectories for the evolution of the electricity mix 2020-2060 – Synthesis of the study.

DENA, (2018). Leitstudie IntegrierteEnergiewende – Impulse für die Gestaltung des Energiesystems bis 2050 (Study of the integrated transformation of the energy system – Impelling the change in the design of the energy system until 2050) https://www.dena.de/fileadmin/dena/Dokumente/Pdf/9261_dena-Leitstudie_Integrierte_Energiewende_lang.pdf

FrontierEconomics, (2019). “Potenials for sectorcoupling for decarbonsation: assessingregulatoriybarriers in linking the gas an electricitysector in the EU”. PPT presentation to the Madrid Forum, 6 June 2019 (Author: Christoph Riechmann)

Imperial College (Energy Futures Lab.), (2017), “Unlocking the potential of energysystemsintegration”. Principal author: Richard Lanne)

Pielbags A. and M. Olczak, (2018). (Florence School of Regulation); Sectorcoupling: the new EU climate and energyparadigm? FSR energyWorkingpaper No. 2018-17,

Skytte K. et alii,( 2019), Unsealing a fossil free energy system by geographical, sector or marketcoupling. The case of Denmark

Trinomics, (2018). Sectorcoupling: how canitbeenhanced in the EU to fostergridstability and decarbonise? Report to the IndResearchEnergy Committee of the European Parliament, November 2018. Rotterdam :Trinomics B.V. (Consulting group)

Power to Gaset Hydrogen Economy

ADEME, (2017). A 100% RENEWABLE GAS MIX IN 2050? Techno-economic feasibility study.

Boucly Ph, (2019). Energy transition: Hydrogen as a vector of possibilities. Revue de l’énergie. N°644 / May-June .

ENEA (2016). The potential of power-to-gas. http://www.enea-consulting.com/wp-content/uploads/2016/01/ENEA-Consulting-The-potential-of-power-to-gas.pdf.

FrontierEconomics (2018). The future costs of electricitybasedsynthetic fuels. London: FrontierEconomics reports.

Lesser E., (2019). The match between batteries and fuel cellsd. Transitions et Enernies, n°3, winter 2019, p.31-37

Maroufmashat, A., M. Fowler (2017). “Transition of Future Energy System Infrastructure; through 12 Power-to-GasPathways”, Energies, 2017, 10,

Meus L., Roach M. (2019). “The Welfare and Price Effects of SectorCouplingwith Power-to-Gas”. FSR and RSCASworkingPaper 2019-46

Lambert M. (2018), BIOGAS, BIOMETHANE, AND POWER-TO-GAS , Oxford Energy Forum, September 2018: ISSUE 116 .

Morage J.L., Mudler M., Pérey P., (2019) “Future Markets for green gases and Hydrogen: whatwouldbe the optimal regularory provisions”. September 2019

WEC (2019), “NEW HYDROGEN ECONOMY – HOPE OR HYPE?” Innovation Insights Brief 2019

Power to heat (district heating, industry)

ADEME and ATEE, (2016). Study on the valorisation of thermal storage and power-to-heat.

Bloess A. et al (DIW) (2017), “Power-to-heat for renewableenergy integration: A review of technologies, modelingapproaches, and flexibilitypotentials”, AppliedEnergy

212 (2018) 1611-1626

IEA, (2014), LinkingHeat and ElectricitySystems:Co-generation and District Heating and Cooling. Solutions for a Clean Energy Future, Paris: OECD-IEA

JRC, (2019). Decarbonising the EU heatingsector ,Integration of the power and heatingsector

(Kavvadias K., Jiménez-Navarro J.P., Thomassen G.)

Kiss B., Neij L., Jakob M., (2011). “Heatpumps: a comparative assessement of innovation and dissusionpolicies in Sweden and Switzerland”. Energy Policy. 39 (10), 6514-6524.

Skytte, K., Bergaentzlé C., Fausto F., Gunkel, Philipp A., (2019). Flexible NordicEnergySystems . DTU library

Skytte, K., Olsen, O.J., Soysal, E.R ,Sneum, D.M., (2017). Barriers for district heating as a source of flexibility for the electricity system’. Journal of EnergyMarkets 10(2), 1-19, 2017

Sectoral Coupling and Transport

FrontierEconomics, (2018). The future costs of electricitybasedsynthetic fuels.

Gough et al, (2017). Vehicle-to-gridfeasibility: A techno-economicanalysis of EV-basedenergystorage, Science

Merley J., Vilain L., (2018). Energy storage in the electrical system: a multifaceted object. n°640 / September-October 2018

Article References

[1] The acronyms PtoH and PtoG are also used

[2] Frontier Economics 2019.

[3] Refer to Appendix 2 for further explanation of the economic evaluation methodology for P2G options

[4] AEN-OECD, 2019.

[5] That is almost half the number of hours in the year, 8,760.

[6] ENEA 2016; Trinomics,2018; FrontierEconomics, 2018; JRC, 2019.

[7] Enea and trinomix, among others.

[8] Pielbags and Olczak, 2018.

[9] See Annex 1.

[10] According to a study by Morag and Mudler (2019).

[11] IEA, 2014 Linking Heat and Electricity Systems, p.7

[12] Main source: ENEA, 2018

The Energy Encyclopedia is published by the Association des encyclopédies de l’environnement et de l’énergie (A3E)(www.a3e.fr), contractually linked to the University of Grenoble Alpes and Grenoble INP, and sponsored by the French Academy of Sciences. To cite this article, please mention the name of the author, the title of the article and its URL on the Energy Encyclopedia website. The Energy Encyclopedia articles are made available under the terms of the Creative Commons Attribution-Noncommercial-No. Derivative Works 4.0 International License.