Flexible regulation is an effective means of rapidly reducing vehicle emissions without drawing opposition from consumers and politicians.

This article is published in French, under the title : Canada : comment réduire les émissions de CO2 des véhicules ?. It is published in collaboration with Policy Options / Options politiques (http://policyoptions.irpp.org) the digital magazine of the Institute for Research on Public Policy (IRPP), Montreal, Quebec, Canada.

It’s easy for ineffective environmental policy to be politically successful, as Brian Mulroney, Jean Chrétien, Stephen Harper and various provincial premiers have demonstrated for over a quarter of a century. Voluntary challenges, efficiency labels on furnaces and appliances, government R&D, subsidies for electric cars and home insulation, and even public investments in transit, don’t compel anyone to do anything – and are thus mostly ineffective.

When it comes to reducing greenhouse gases (GHGs), to be effective it would require one of three policies: increasingly stringent regulations on technologies and fuels, a rising carbon tax, or a falling absolute cap on emissions (Read: Énergie et climat : la construction des politiques climatiques). Any of these, or a combination, would do. But we must have at least one. And its stringency must increase over time if it is to reach a target.

While policy effectiveness is essential, so too is political acceptability.

1. Flexible regulation of vehicle emissions as an acceptable solution

So, what sorts of effective climate change policies would be less politically difficult than a carbon tax? Several examples of effective regulatory policies are mentioned elsewhere (Read: Canada : Want an effective climate policy?). Just one is studied in detail here: a flexible vehicle emissions regulation.

1.1. Provincial governments not in favour of a carbon tax

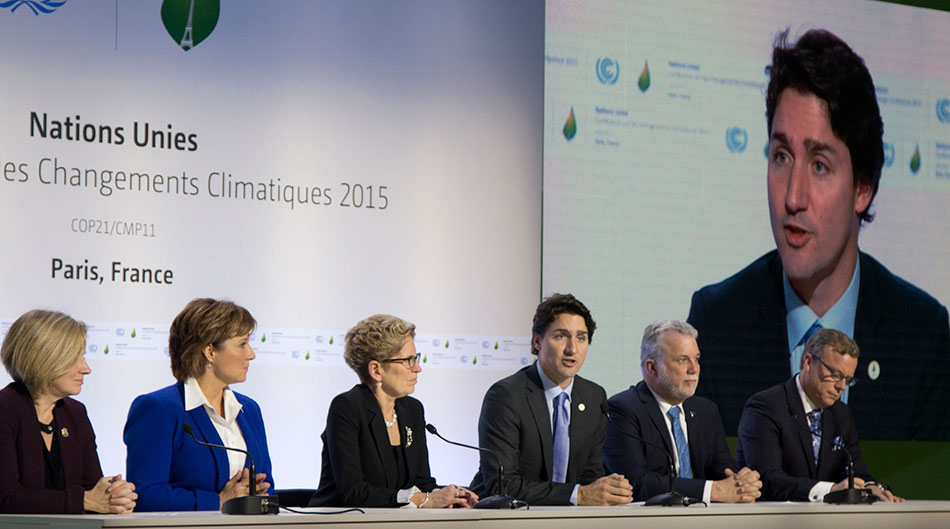

To meet its promise at Paris climate summit in 2015 (Image 1), the Justin Trudeau government would need a carbon tax that rises rapidly from its current level (of $0 to $30 per tonne of CO2, depending on the province) to $160, country-wide, by 2030. This would ultimately increase the price of gasoline by at least 40 cents per litre. This rising price would incentivize new car buyers at a rapidly increasing rate to opt for electric or biofuel vehicles, resulting in dramatic reductions in oil consumption and GHG emissions, especially in the 2020 to 2030 timeframe.

As predicted, Justin Trudeau could not convince all the premiers to agree on even a low carbon price: if the Prime Minister wants to use emissions pricing to meet climate targets, he will pay the political price.

Trudeau and the premiers created study committees, a typically Canadian choice in case of impasse. One of these committees is exploring approaches to rapidly reducing vehicle emissions, and ones that don’t require political suicide. If the provinces don’t agree, the federal government must go it alone. Either way, the vehicle policy proposed here should be implemented at the federal level.

1.2. A regulation alternative

What would this proposal look like? It consists of a flexible regulation of vehicle emissions that would require vehicle sellers (manufacturers and retailers) to grow gradually each year the market share for partial-zero-emission vehicles (PZEVs) and zero-emission vehicles (ZEVs).

For PZEV, think Chevy Volt, plug-in Toyota Prius (Image 2), or perhaps cars whose fuel must be 85 percent ethanol. For ZEV, think Nissan Leaf, Tesla, or a biodiesel pick-up truck.

By 2020, 10 percent of new vehicles should be PZEV-ZEV. By 2030, the PZEV-ZEV share should reach 70 percent. They would pay a $10,000 fine for each conventional-fuelled vehicle sold that keeps them from meeting their target.

This type of policy is sometimes referred to as a niche market regulation, because it guarantees an initially small but growing market share for transformative technologies, which would otherwise have great difficulty unseating gasoline and diesel incumbents.

1.3. Better social acceptability

Would this policy be politically easy to implement? It certainly would not. Like all effective climate policies, it would meet resistance.

Many vehicle manufacturers and retailers would argue that they cannot possibly achieve the sales requirements, because not enough consumers will buy PZEVs and ZEVs. They would try to convince voters that government is engaging in social engineering, forcing people to buy vehicles they don’t want. This would not be true. However, as in war, truth is the first casualty in climate policy.

So government would have to stick to its guns. And difficult as this might be, it would be far less difficult than defending a rapidly rising carbon tax that attracts hostile media attention with each increase.

2. Niche market regulation of PZEVs and ZEVs: As flexible as a carbon-tax

Because of its flexibility, this regulation mimics many of the innovation, investment and consumer-choice attributes of carbon taxes or emissions permit prices in a cap-and-trade system. It preserves thus economic actors’ freedom of choice.

2.1. Flexibility in terms of quantity sold per vehicle type

While the regulation might initially stipulate a 50/50 split between the PZEVs and ZEVs sold and calculate emission reductions on that basis, vehicle sellers could shift this ratio, and even the size of the niche market, as long as the same overall effect on emissions is achieved. Thus, if more ZEVs than PZEVs are sold, the combined market-share target in 2020 could be reduced from 10 percent to, say, 8 percent. Conversely, if PZEVs dominate, the target would be raised above 10 percent.

And vehicle sellers could trade among themselves in achieving the overall PZEV-ZEV market outcome. Since all Tesla vehicles (Image 3) are zero emission vehicles, in 2020 that company would have surplus credits from 90 percent of its vehicles sold, which it could then sell to other manufacturers who might find it cheaper to purchase these from Tesla than to develop their own ZEVs in time for this near-term deadline.

2.2. Flexibility in terms of commercial strategy

To avoid the $10,000 penalty, vehicle manufacturers would have to market PZEVs and ZEVs vigorously, working hard to attract new buyers motivated by environmentalism, a love of new technologies or a quest for status.

Manufacturers would also have to innovate in order to lower production costs (and improve battery performance in the case of electric vehicles) to ensure that these vehicles were increasingly attractive to a wider market.

And if the marketing and innovation efforts were insufficient, sellers would have to cross-subsidize; i.e., charge a modest premium for many conventional vehicles in order to lower the price of PZEVs and ZEVs below their full production cost.

In 2020, when the niche market would be only 10 percent, a mark-up of $100 on all gasoline vehicles would be sufficient to lower the asking price of the relatively small number of PZEVs and ZEVs significantly. In 2030, when the niche market would be 70 percent, the price increase on conventional vehicles would need to be greater to cross-subsidize sales of the PZEVs and ZEVs.

But this might not be necessary if, during the decade, vehicle manufacturers had managed to lower production costs in their aggressive efforts to capture the greatest share of the rapidly growing PZEV-ZEV niche, while prospective buyers had become more confident with these technologies, thus needing less of a price inducement. And all of this would have happened without government imposing rapidly rising carbon taxes.

2.3. Flexibility in terms of technological innovations

Carbon tax advocates argue that their policy stimulates the innovations that lower the costs of GHG reduction. So does the proposed PZEV-ZEV regulation. Carbon tax advocates also argue that their policy lets the market decide on technological winners. So does the PZEV-ZEV regulation.

While we know that the market share of near-zero-emission vehicles must grow rapidly over the next two decades, we don’t know how manufacturing costs and consumer preferences will evolve in determining the mix of pure-electric, plug-in hybrid electric, hydrogen-fuel-cell (Image 4), ethanol, or biodiesels (Read: L’automobile du futur : quelle source d’énergie ? and L’automobile du futur : les technologies énergétiques en compétition).

The PZEV-ZEV regulation would let the market decide, as producers compete for customers in the rapidly expanding low- and zero-emission vehicle market that we know we must have if we are going to meet our emission commitments.

While this policy creates an incentive that results in significant emissions reductions, it does not stipulate a specific technological outcome.

3. PZEV-ZEV regulation vs. carbon tax: Drawbacks in efficiency to be put in perspective

It has to be made clear: we are not talking about considering that PZEV-ZEV regulation would be superior to the carbon tax, but let me go through some of the textbook arguments that would likely be regurgitated for why the carbon tax is economically superior to the proposed regulation.

3.1. The lack of incentive towards new consumer behaviours

Because the PZEV-ZEV regulation would not increase the price of gasoline, it would provide minimal incentive for people to drive less or switch to low-emission alternatives like transit and cycling (Image 5).

We would need additional policies to achieve these goals. But even in jurisdictions that have carbon pricing (these prices being very low because of the political constraints), governments invest in transit, bike paths and restrict vehicle access in various ways.

3.2. The lack of incentive to renew the stock of vehicles

The rising price of gasoline because of a carbon tax would presumably accelerate the retirement rate of gas-guzzlers, while the PZEV-ZEV would not.

However, my calculations suggest that this argument is valid only if the carbon tax is rapidly increasing the price of gasoline, which does not happen when political constraints prevent a high carbon tax. In any case, this is of little significance, because almost the entire stock of personal vehicles will be renewed by 2030.

3.3. The risk of windfall effect

The lack of carbon pricing makes it difficult to ensure that ethanol- and biodiesel-capable vehicles will not use a lot of conventional gasoline and diesel.

So, to have PZEV-ZEV status, these vehicles must avoid this by means of some tamper-resistant mechanism (constricted fuel nozzles? electronic sensors?).

If this is impractical, the PZEV-ZEV regulation will need, in addition, a fuel-focused regulation, in the same way that California combines its vehicle emissions regulation (which is similar to my PZEV-ZEV proposal) with its low carbon fuel standard.

4. The same real economic effects

Economists point out that the revenue from emissions pricing (carbon tax or auctioned permits under cap-and-trade) can have important economic impacts whereas regulation doesn’t generate any revenue. Is it actually true?

4.1. No income taxes reduction

Economists point out that the revenue from emissions pricing be an economic stimulus if it is used to reduce corporate and personal income taxes.

Indeed, regulations like this PZEV-ZEV proposal would not do this. But again, if carbon-emissions prices remain stuck at low levels, the macro-economic benefits of revenue recycling in this way would not be great. And, in any case, most jurisdictions that have emissions pricing, such as California, Quebec and Ontario, spend considerable auction revenues on subsidies and other programs, instead of on reducing income taxes.

4.2. Financial transfers with redistributive effects

Emissions pricing advocates also argue that carbon tax revenues, or auction revenues from permit auctions under cap-and-trade, can be used to compensate those who are most adversely affected by climate policy.

True, the PZEV-ZEV regulation would not generate government revenues for this purpose. But because the PZEV-ZEV regulation would allow for a wide range of vehicle types, including gasoline vehicles, sellers could continue to price-compete for lower income consumers.

Rather than occurring through the government’s carbon tax regime, transfers between income groups would occur between consumers of different types of vehicles, through the longstanding auto industry practice by which above-cost revenues from luxury vehicles and frivolous options on standard vehicles enable lower prices for the basic models that are marketed to budget-conscious consumers.

Conclusion

Yes, carbon taxes are the most economically efficient policy, and emissions pricing through cap-and-trade runs a close second. But can we not learn from 25 years of climate policy failure? (Image 6) Can we not ask ourselves to be creative and design flexible regulatory policies, which have a far better chance of succeeding politically?

At the same time, we would be growing niche markets for the low-emission technologies that are already commercially available, but currently are destined to spend decades in a marginal role.

And by doing that, we would be improving the prospects for effective emissions prices. Future politicians might well find it easier to raise the carbon price once consumers (read voters) have overwhelming market evidence of reliable and desirable alternatives to their cherished gasoline and diesel vehicles.

Yet, it does not seem to be the choice since Finances federal Minister Bill Morneau (Image 7) has just published the draft of a bill to initiate a mechanism of a federal carbon tax from 2019, with an initial amount of 20$ a ton[1].

Notes et références

[1] Annie Bérubé (15-01-2018). Mettre un prix sur la pollution carbone à travers le Canada – cours 101 d’un système à deux, trois ou quatre vitesses… Equiterre, Available on : http://equiterre.org/choix-de-societe/blog/mettre-un-prix-sur-la-pollution-carbone-a-travers-le-canada-%E2%80%93-cours-101-dun-sy [Accessed on 30/01/2018]

Complementary Bibliography

Jaccard Mark (2016). Want an effective climate policy? Heed the evidence. Policy Options, the public forum for the public good, February 2. Available on: http://policyoptions.irpp.org/magazines/february-2016/want-an-effective-climatepolicy-heed-the-evidence/ [Accessed on 20/09/2017].

Jaccard Mark (2016). Penny wise and pound foolish on climate policy? Policy Options, the public forum for the public good, October 11 . Available on: http://policyoptions.irpp.org/magazines/october-2016/penny-wise-and-pound-foolish-on-climate-policy/ [Accessed on 20/09/2017].

Jaccard Mark (2016) Effective climate change regulation: Let’s transform Canadian cars. Policy Options, the public forum for the public good, May 31. Available on: http://policyoptions.irpp.org/magazines/may-2016/effective-climate-change-regulation-lets-transform-canadian-cars/ [Accessed on 20/09/2017].

Criqui Patrick, Jaccard Mark (2017) Quels instruments pour mettre en œuvre l’accord de Partis ? L’exemple canadien. Available on: https://theconversation.com/quels-instruments-pour-mettre-en-oeuvre-laccord-de-paris-lexemple-canadien-85915[Consulté le 30/01/2018].

L’Encyclopédie de l’Énergie est publiée par l’Association des Encyclopédies de l’Environnement et de l’Énergie (www.a3e.fr), contractuellement liée à l’université Grenoble Alpes et à Grenoble INP, et parrainée par l’Académie des sciences.

Pour citer cet article, merci de mentionner le nom de l’auteur, le titre de l’article et son URL sur le site de l’Encyclopédie de l’Énergie.

Les articles de l’Encyclopédie de l’Énergie sont mis à disposition selon les termes de la licence Creative Commons Attribution – Pas d’Utilisation Commerciale – Pas de Modification 4.0 International.